The notion that a tardy Competition Tribunal was the reason for the cancellation of the proposed merger between Sun International and Peermont becomes more laughable by the day.

That’s because each day the Sun International share price maintains the much stronger position to which it surged on news that the transaction was abandoned. Over the past year or so investors came around to the view this was a bad deal for Sun, having voted for it back in early 2024. Whether they thought it was a strategically bad move or just a badly priced one is unclear. But, judging by the recent share price performance, they thought it was bad enough to rejoice when it was shelved.

So, it’s difficult to imagine the Sun International board and management hadn’t come to the same view of the merger long before the July 2 announcement that the deal was off.

Suggesting, however subtly, that the tribunal was to blame, is disingenuous. Closer to the truth would be that the merging parties and the intervening party (Tsogo Sun) were responsible for scheduling delays that ultimately resulted in the deal’s closure heading beyond the October 2 long-stop date.

As it happened, it was the Constitutional Court that gave Sun International a “get out of jail free” card. A clash of schedules between the court and the tribunal meant the tribunal’s August hearing had to be scrapped. An October date was suggested; October 2. And, hey presto, the casino merger could be abandoned without either party having to fork out the R75m break fee.

While it’s not unusual for the competition authorities to be blamed for all manner of evils visited upon the South African economy, this time the tribunal seemed particularly irked with being blamed for the collapse of a commercial transaction.

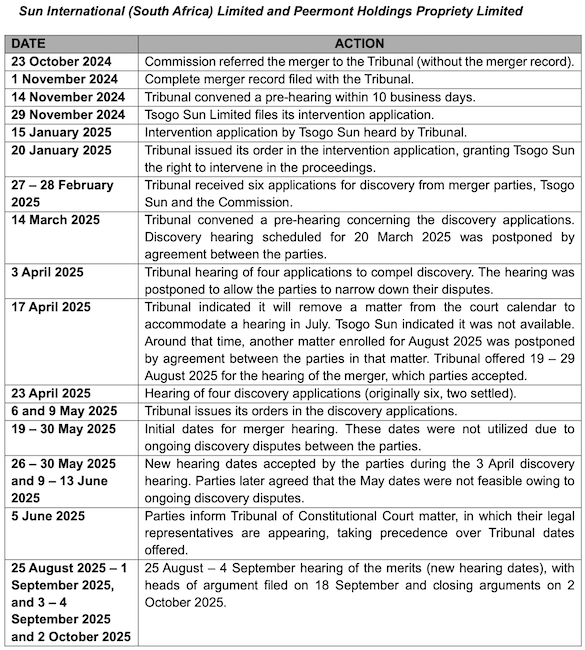

And so, it took the unprecedented decision to release a timetable of the events leading up to July 2. It makes for fascinating reading.

It turns out the real culprits were Sun International, Peermont and Tsogo. And, as it happens, their legal teams.

The tribunal’s hearing of the merger – as opposed to an intervention or discovery hearing – was initially scheduled for late May. But this had to be scrapped because of ongoing discovery disputes between the merging parties and Tsogo.

The tribunal said it would remove a matter from its July calendar to accommodate Sun International et al. However, this didn’t suit Tsogo.

As luck would have it, in mid-April another matter scheduled for a hearing in the second half of August was postponed. The dates (August 19-29) were offered to the merging parties and Tsogo, and they all accepted. So, the deal was on track to be completed ahead of the long-stop date.

But then along came the Constitutional Court, which announced it was hearing the Competition Commission’s case against 13 international banks who are alleged to have manipulated the foreign exchange market. It seems that several members of the legal teams involved in the Sun International/Peermont merger were also involved in the forex case. This meant the tribunal’s dates had to be scrapped, yet again.

The earliest date the tribunal could accommodate another hearing was October 2. And there it was – Sun International’s “get out of deal free” card.

A slow process

No doubt the competition authorities do slow down the merger process in South Africa. It’s almost part of their job description – when a transaction is large, interrogate it to determine who might be prejudiced by it. And given how few mergers actually achieve the claimed benefits, this may not be such a bad thing.

But the Trumpian notion that companies should not be restrained from doing whatever they believe might boost short-term profits is hardly appropriate in the 21st century. Even in Trumpland.

That said, the authorities do need to be better resourced and should be discouraged from using public interest considerations to extract non-commercial commitments from merging parties.

Equally, the corporate sector needs to be aware of the role it plays in dragging out the compliance process.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.