Elite policing unit The Hawks have taken statements in preparation for laying possible criminal charges against the “Didata Six” for fraud in connection with the sale of the company’s sprawling Bryanston offices, The Campus.

This escalation from a corporate fallout to a criminal probe adds a new dimension to a case that has grabbed the attention of South Africa’s corporate titans, highlighting the ease with which Black empowerment rules can be cynically manipulated.

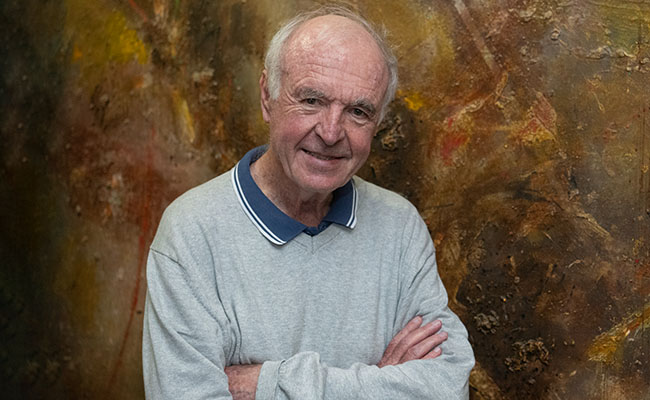

In January, the Japanese company that owns Dimension Data, NTT, lodged a criminal complaint against a group of former executives led by former chair Jeremy Ord, after an excoriating high court ruling in November said they had put together an “illegal scheme designed to appropriate for themselves a secret financial benefit”.

Judge Denise Fisher found that Jeremy Ord, Bruce Watson, Jason Goodall, Grant Bodley, Saki Missaikos and Steven Nathan – the so-called “Campus Six” – had orchestrated a “brazen and dishonest” scheme using Sonja de Bruyn’s women-led Identity Property Fund as a front.

The deal dates back to November 2019, when Didata struck a “landmark” deal to sell its flagship property, The Campus, a 75,000m2 office block, for R1.4bn to a “consortium of Black women”. In reality, Fischer said, The Campus would end up owned by a fund whose only investors were those six white businessmen.

Fisher said Ord and the executives sat on both sides of the deal – orchestrating the sale of the Campus, while also secretly being part of the buyer – without disclosing this conflict of interest. NTT vendor-financed R1.3bn of the purchase price, which it says it never would have done had it known the executives were involved.

De Bruyn told Currency that her fund was similarly “misled and taken advantage of”. This was a “sad cautionary tale of the abuse of a credible women-led BEE structure to the undisclosed benefit of a few white privileged or powerful men”, she said.

The ruling caused waves since, as Fisher said, it put at centre stage “the functionality of the Black economic empowerment legislation and system, which is crucial to the economic transformation of South Africa”.

While those six executives have appealed Fisher’s ruling, NTT wants criminal sanction. In recent weeks, Currency News has spoken to a number of people involved in this case – some of whom have been contacted by the Hawks to obtain statements – which suggests a decision on a prosecution may be imminent.

“The Hawks in Gauteng [are] investigating a case of fraud and theft. The investigation is currently at an advanced stage,” spokesperson Thatohatsi Mavimbela confirmed to Currency this week.

When contacted, NTT’s lawyer Ian Small-Smith said the company had no comment but it “looks forward to the outcome of the investigations” by the Hawks and other law enforcement authorities.

Precedent-setting

The fact that the Hawks are investigating this fronting case sends a strong message to the corporate sector.

Tshediso Matona, the head of the Broad-Based BEE Commission, told Currency that any criminal conviction would set a much-needed precedent, and deter others from breaking the rules.

“If indeed the legislation has been contravened, we would like to see consequences. Until now, we haven’t seen any convictions for fronting, even though we’ve referred 21 cases to the authorities, so we want to see this taken seriously,” he said.

The BBBEE Act says it is an offence to “misrepresent” a company’s empowerment status, while section 75 of the Companies Act requires directors to disclose their interest in any deal. Fisher underscored this last point, saying that legally, directors have a duty to avoid conflicts of interest, and to disclose their interest in contracts.

Instead, she said, the executives went out of their way to keep their interest “secret at all times”.

Criminal charges would be a serious blow to the reputation of those high-flying executives who, at one time, led the successful technology company. Didata, founded in 1983, became South Africa’s most valuable tech firm, attracting the attention of Japan’s NTT, which bought it for R24.2bn in 2010.

The executives “aren’t going to be commenting at this stage” on potential criminal charges, a communications consultant speaking on their behalf said this week.

Nonetheless, a criminal case, while mirroring NTT’s civil case against them, won’t be a slam dunk. For a start, the allegations would have to be proved beyond a reasonable doubt rather than on a balance of probabilities, and those executives have already appealed Fisher’s ruling, arguing that she made serious errors.

In their appeal, the former Didata executives said the view that they hijacked an empowerment deal to feather their own nests “is just plain wrong and deeply distressing to us”. They said Fisher’s findings were “unjustified and unfair”.

In particular, they argued that they had not made the decision to invest in The Campus at the time when Didata decided to sell that property. As a result, they said it was wrong to claim they hid their interest in the transaction.

But the executives’ case took a body blow last month when Martin Epstein, the property consultant on The Campus deal, signed an affidavit disputing their version of events.

While Didata took a resolution in November 2019 to approve this deal, Epstein said he had been told four months earlier, in July 2019, that Ord and Missaikos “would be investing in the structure”, and a draft agreement had already been drawn up.

“Mr Ord voted in favour of this resolution and disclosed no conflict of interest,” he said.

That Didata resolution authorising the deal was explicit that “no disclosures were made in terms of section 75 of the act and each director, by his signature hereto, confirms that he or she does not have any personal financial interests … in the matters described”.

Epstein, explaining why he had kept silent until that point, said he’d initially been told by Didata’s lawyers that he was not germane to the case as he hadn’t been a director. But he said that when Fisher’s judgment emerged, he was shocked by the implication that he was part of the conspiracy.

“My silence [was] not a product of my complicity in what had happened, but rather a combination of the incomplete legal advice I was given,” he said. He has since engaged a top-class legal team led by Jac Marais of Adams & Adams and including Kate Hofmeyr SC.

Epstein told Currency this week that he doesn’t believe there is any basis for charging him criminally, and he “will engage with the Hawks on this basis”.

Asked whether she would testify in any criminal trial, De Bruyn said this week that “the law should take its course, and of course, we will co-operate fully with any investigations”.

Manipulated price

Much of the criminal case will hinge around the non-disclosure of the conflict of interest, and the extent to which NTT had been misled by Ord’s group.

But the documents look bad for them at this point. For example, when Nathan was asked who would benefit from the deal while it was being negotiated, he said it would be “widespread” with potentially “hundreds” of people benefiting.

The executives allegedly even did their best to keep the price as low as possible, to secretly benefit themselves, while they were supposedly representing NTT as the seller.

At one point, when Didata’s more junior staff questioned why The Campus was being sold for R1.4bn – far below its value of R1.6bn in the company’s accounts – Nathan argued “there is significant discount” and added that the buyers “are being stretched”.

In the end, NTT believes, it was the truth that was being stretched.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.

The bottom line is that if the transgression of Section 75 involves fraud (e.g., knowingly concealing an interest to defraud), it may constitute a criminal offence under section 214, allowing a judge to impose up to 10 years’ imprisonment, a fine (at the court’s discretion, with no specified maximum), or both under section 216. That is what is at stake here.

M

What about Mr Andile Ngcaba,he is not being mentioned because he was a Boss of some sort at Dimension Data?

Would you dig deep into Sonja De Bruyn past BE Dealings? Something fishy about her.

Let’s bring out all the other criminal behaviour ask OM about price fixing in their security devision in CT where they relocated the team outside of SA . Fortinet is another clue !

Its a system that was meant to benefit Black persons…..BEE. This BEE is pretty young in its infant years an can lean anyways depending to whom it must bend

It is now WEE (White econ emp)

Any system can be manipulated given the tees an cees applicable. However the law is not young an its at this point where hindsight & oversight an this law an that article was overlooked…blatantly bcos of

Not BEE

Not WEE

But GREED

These guys come fitted with legal eagles so its pretty strange that counsel gave them such advice.

I remember DiData share price manipulation back in the day by the same peeps.