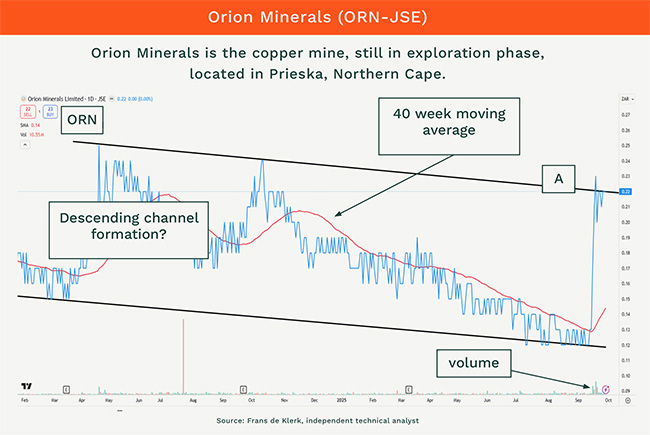

Orion Minerals, whose Prieska mine in the Northern Cape is still in the exploration phase, has recently caught our eye – largely for the volumes traded in the micro-cap stock. The company recently announced a financing and off-take deal with mining giant Glencore worth up to $250m, and buyers will be happy above 22c a share.

As per the graph, a descending channel formation, which could be positive, may be holding investors back.

Above line A (22c) the descending channel might break to the upside and chase a target of 30c a share. Below 16c a share, however, the stock could fall further with a floor of 10c a share.

Traders should buy or consider a long position in Orion as close to line A as possible if they believe that the descending channel will play out to the top, but use 15c as a stop loss to protect capital. Possible targets to the top range are from 23c a share to 32c.

For medium to long-term investors, do the same as the traders but consider a stop loss at the same level. The 50-day moving average (which is the red line on the chart at 14c a share) is a great barometer to measure investment sentiment. Above the average, investors are generally more confident; below the average, investors may get nervous.

The views reflect the opinion of the writer and are not to be construed as financial advice.

Frans de Klerk is an independent technical analyst.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.