Currency has previously raised the issue of the rather odd situation that is big business in South Africa bending over backwards to help the same government that is hurting business. The recent announcement by Business for South Africa (B4SA) that it’s considering making the shambolic city of Joburg it’s fifth big intervention (after energy, rail, crime and youth job creation) made us wonder whether the presidency – worried about the ANC losing Joburg in the local government elections next year – needs to draft in “its” team of heavy hitters. We put the issue to B4SA’s chair, Martin Kingston.

What would B4SA’s involvement – if it decided to get involved – in Joburg look like?

We don’t know yet, because there are two preparatory comments – one which is that for all of the good work of the partnership between government and business, while we have Joburg in the state in which we currently find it, that undermines the public perception of progress.

Isn’t there a very real danger that you get inveigled by sweet-talking Cyril Ramaphosa? Are you not being used here to stave off the ANC’s loss of Joburg?

No, I don’t think so at all. I mean, the assumption there is that we are extremely politically naive and that we don’t understand that local government elections are upon us. And, second, that’s like suggesting the work that is happening from Jozi My Jozi, say, is being done to prop up the ANC and quite frankly that’s absurd. In fact it’s been done independent of the city, perhaps we should say, despite [the city]. Jozi My Jozi is a successful initiative as are many of the others.

Relatively successful. Not wholly …

Well would you rather the whole thing just collapsed? Where does that get anybody? I think it’s really interesting this conversation because a lot of people have said that the partnership makes a material difference in dealing with energy and crime and corruption. Would people rather have no support from business at all? And what happens thereafter?

This is not a ruse by anybody, including by the way the president, to prop up the ANC. This is an attempt to see whether or not what we have done elsewhere in the context of the partnership with the GNU [government of national unity] – and by the way we don’t care if it’s the ANC or the DA – we care it’s a democratically-elected government that respects the rule of law and the sanctity of the constitution. And I don’t use those words lightly because I can assure you that if there was a political party that didn’t, business wouldn’t get involved.

And we haven’t taken a decision. We’re going to assess whether there is scope for us to get involved and of course – of course – we are mindful of the fact that we are not going to be used as pawns in a political process.

From your perspective, what are the key failings in government? Lack of will, lack of skills?

I think there is a lack of willingness to take difficult and perhaps challenging decisions and that precedes, in my opinion, the capacity to implement. So we … have provided, at arms length, skills and capacity. And the third is crime, corruption and maladministration in the system. And those are all political challenges. A number of key decision-makers are intimidated by the circumstances in which they find themselves and are therefore reluctant to take what may be controversial but necessary decisions.

Would you say the biggest success on the part of B4SA’s involvement with government was the stabilisation of power supply?

Absolutely.

But are you disheartened that we haven’t seen any sort of real rebound in economic growth?

Yes, very.

Why do you think that is?

I think there are two reasons. One is the implementation of structural reforms, and the second is improving operational efficiency. Not wide enough, and not fast enough. And there’s a long lead-lag timeframe in all of this. We’ve got no choice but to hang on and put our shoulder to the wheel. But the last point is that when we start seeing a continued level of progress being made, we’ll see confidence levels rise and confidence levels, as you know, result in investment. We should not underestimate how long it takes to build confidence.

There’s also an argument that big business would rather deal with the devil it knows. Do you think business has helped keep the status quo in place for too long?

No, I don’t really think so. I think the electorate doesn’t really care what business does for the most part, and I don’t think they’re swayed by that – they’re swayed by delivery. To go back to Joburg, the local government elections will be the test of that. And in Joburg there is quite frankly shocking delivery to the people who should, a) receive those services; and b) pay for them.

Is a call on Joburg a collective decision by the members of B4SA? Do you talk to all the members and it’s put to a vote?

We said to the president when we met him five weeks ago that we would assess whether or not there’s a role for us to play and that process is taking place at the moment. We’re not going to step on people’s toes – that’s not our role. If people think we’d add value we’ll consider that. We will then make a recommendation to the steering committee of B4SA and then we will sit with the government and agree whether or not it’s appropriate. I hope that we will be there in the next couple of months.

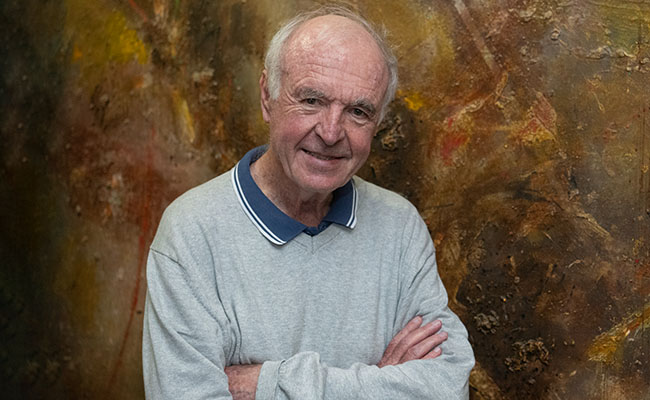

Top image: supplied.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.