The JSE has taken to the courts to force Mike Miller, the CEO of Mantengu Mining, to back-up his claims of widespread corruption and share manipulation at Africa’s largest stock exchange, or shut up.

On Thursday the JSE lodged papers in Joburg’s high court, in a case which the exchange’s director of issuer services Andre Visser describes as vital to ensuring “investor confidence that the market is efficient, effective and is independently regulated”.

This comes after Mantengu published a paid-for article on Business Day’s website this week alleging the most sensational conspiracy yet on South Africa’s market.

“There is strong evidence to suggest that the JSE, together with certain [police officials are] entangled with a sophisticated criminal syndicate using the exchange as cover for share price manipulation, money-laundering and racketeering,” it said.

Mantengu said this “systematic pattern of fraud” undermines the JSE’s claim to be a “highly ethical organisation”. Miller said that “until the JSE has cleaned house”, companies should “think very, very carefully” about listing on the exchange.

In social media posts, Miller elaborated on this, claiming there is a “syndicate” of buyers and sellers who routinely conspire to manipulate share prices, particularly of property and mining companies to “force a change of control”. He says emails provide damning evidence of this.

Miller, 43, said his company has lodged a criminal complaint with the Hawks – the directorate for priority crime investigations – including against the JSE and its officials.

The accusations, wild as they might seem, are deeply damaging to the exchange. Yet until now, the JSE has remained quiet in public, even though it has challenged Miller in a series of letters to both it and Mantengu’s corporate sponsors.

In the court papers, the exchange says it now has to act as Miller’s claims could “undermine investor confidence” and cause “a systemic risk” to the local market.

In his affidavit, Visser says there is no evidence to suggest Miller’s claims are true, while the JSE’s staff and directors “have been wrongly and unjustly targeted in the crossfire of Mantengu’s social media campaign”.

The JSE now wants the court to order Miller, at an urgent hearing on November 18, to give it those emails within 24 hours. Unless there is evidence to back up what he is saying, the bourse wants the court to permanently interdict Mantengu from saying its staff are “complicit in unlawful activities”.

“Mantengu has made very serious allegations against the JSE, its directors and its employees, but when requested to provide the primary facts on which it relies, which are the emails, it refuses to do so,” says Visser.

He says this undermines “the integrity of the markets and the reputation of the JSE”, while frustrating the exchange’s duty to ensure the markets operate fairly, efficiently and transparently.

‘Go to the Hawks’

Visser argues that if Miller is right, this information should indeed be made public.

“The issue is whether it is true,” he says. “The JSE denies the allegations are true, and has obtained an affidavit from each of its directors to confirm they were not party to the emails and have not been involved in unlawful conduct.”

The JSE’s legal action is a dramatic escalation in tensions between the chrome miner and the exchange, which have been bubbling for months. But it seems Miller has no intention of handing over the documents that the exchange wants.

Speaking to Currency yesterday, Miller said he will not give those emails to the JSE.

“We’ve been instructed by the Hawks not to release anything to the JSE and if they don’t like that, they can go to the Hawks directly,” he said.

Miller, a chartered accountant, said the only reason the JSE wants the information now is because “they are panicking”. He said Mantengu tried to engage the JSE repeatedly over this issue, but it was “extremely hostile to us” from the beginning.

He said he met the Hawks this week to provide them with more details of the supposed wrongdoing. “I met the entire team, I submitted the supplementary [evidence] with all the emails on Tuesday.”

This information, he said, includes recordings of how “the syndicate” works, including emails from JSE directors “communicating where there’s clear inside information and where they’re taking money in cryptocurrency”.

Miller claimed the “syndicate” consists of more than 50 people who have laundered illicit money through the stock exchange, with the assistance of insiders who have tried to cover it up.

Mantengu, he said, had “inadvertently become whistleblowers to massive manipulation on the stock exchange and we do have the evidence to back up what we say”.

He described this as an “existential risk” to the market, which cannot be wished away.

The trail of correspondence between Mantengu and the JSE over the past few months attests to the icy relationship between the mining company and the exchange on which it is listed — and this will all be fully ventilated in court in the next 12 days.

FSCA finds nothing

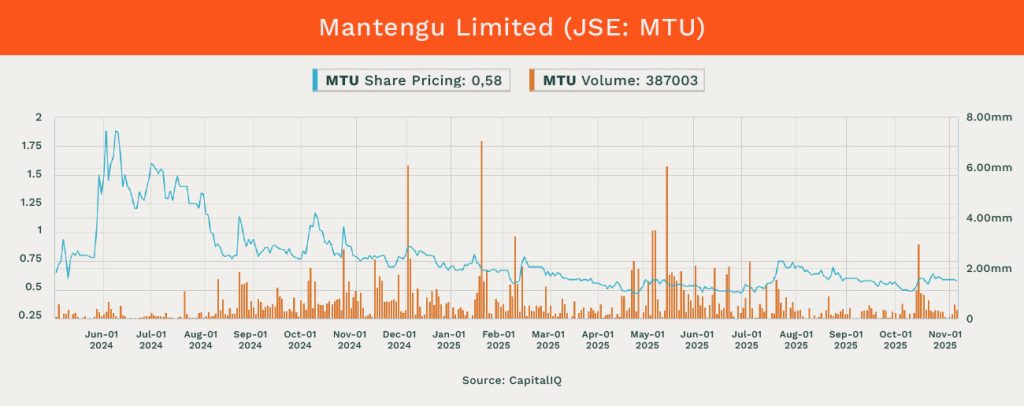

The fracas appears to date back to last October, when Mantengu announced that it planned to buy a company called Blue Ridge Platinum. Miller claimed that almost immediately, Mantengu’s share price began to move down sharply, while the volume of trading spiked.

This is arguable. Trading records examined by Currency show there were several high volume days after the announcement, but the real high volumes only began this year.

Nonetheless, Mantengu’s share price began to dwindle from a high of R1.20 shortly before the Blue Ridge announcement all the way down to 50c in April, after which it recovered somewhat.

In April, Miller fingered a commodity trading company called Liberty Coal — which operates the Optimum coal mine previously owned by the Gupta family — as central to the “price manipulation”. He claimed Liberty and certain JSE staff were trying to “sabotage” the Blue Ridge deal.

Liberty Coal seemed surprised. It denied it was involved, pointing out that it neither trades nor mines chrome, has no interest in Mantengu, and didn’t in fact know the company existed. It accused Miller of harbouring “delusional fantasies” and launched legal action to claim R250m in damages for defamation.

But the JSE advised Mantengu to lay a complaint with the Financial Sector Conduct Authority (FSCA), the regulator which is responsible for investigating stock manipulation.

In May, the FSCA came back to say it had found no wrongdoing; the stock trades amounted to “lawful securities transactions in the ordinary course of business”.

The FSCA went further, adding that while it had seen media reports that Mantengu had laid criminal charges against the JSE’s staff, it found “no reason to suspect improper conduct by the JSE or any of its officials.”

Mantengu was incensed. It went to court to interdict the FSCA from releasing its investigation report to anyone, including Liberty Coal, which wanted to use the findings for its defamation case.

Miller then tried to publish his claims about the “syndicate” on the JSE’s Stock Exchange News Service (Sens), including evidence from “highly sensitive recent whistleblower disclosures, authenticated forensic materials and first-hand evidence submitted to law enforcement”.

The JSE refused. In a letter sent to Mantengu on September 15, the JSE said “the information in the proposed Sens announcement does not fall [within] the ambit of relevant company information, which includes price sensitive information”.

So Mantengu took the JSE to court to allow it to publish this information. It was a futile exercise in the end, as Joburg high court judge Seena Yacoob refused to overrule the JSE, saying the company had provided no evidence to show the case was urgent.

Yacoob also criticised Mantengu for abusing the court process, saying it had “not made full disclosure to the court” about the FSCA report. The judge said the Sens announcement that Mantengu wanted to publish was “neither accurate nor complete”.

Miller today argues that the FSCA’s report was fundamentally flawed anyway.

But surprisingly, he says he found an “ally” within the FSCA who advised him to take the report on review as the regulator was “pressurised into rushing an opinion”.

Mantengu now has a chance to file opposing court papers to respond to the JSE, ahead of what the exchange hopes will be an urgent hearing on November 18. It promises to be an explosive case that threatens to expose conspiracy theories, ruin reputations, or both.

Top image: Mantengu CEO Mike Miller. Picture: mantengu.com; Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.

With how unprofessional the conduct ahs been of the company flouting sens rules and interaxting with the JSE and rven people on twitter, they should get what’s coming to them. If company culture starts at the top, there is no culture to be found.

Delist the damn thing. it is a mangy dog with fleas and Mile Miller is carrying out a PR exercise using SENS.