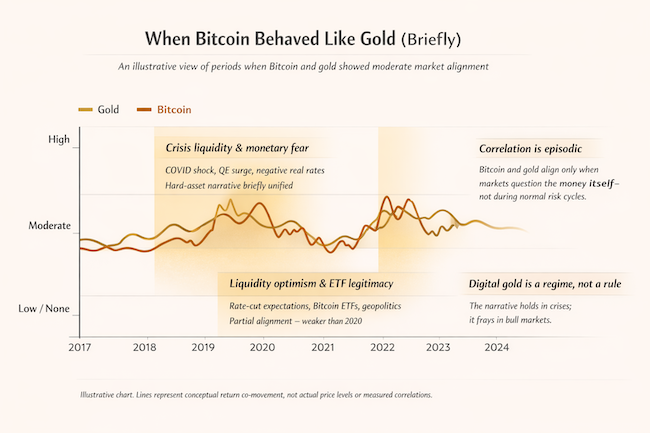

Gold and bitcoin are supposed to share a crucial, underlying, existential characteristic: they are both negative assets that are intended to hedge against global uncertainty and inflation. Yet over the past year, gold is up 82% and bitcoin is down 12%. What’s going on here?

In technical terms, this negative characteristic is known as “the debasement trade”; when governments and central banks expand the supply of money faster than the supply of real goods, the unit of account is quietly hollowed out.

This is not the same as hyperinflation; instead, it is about expanding central-bank balance sheets, structural fiscal deficits and a political reluctance to impose the pain of tax increases and spending cuts. And this is pretty much what is happening almost everywhere in the world at the moment – in spades.

The idea is that, because trust is likely to erode over time, it might be a good idea to buy assets that can’t just be printed into existence, like fiat currencies. Voila! Gold and bitcoin.

All of this is playing into the hands of gold bulls, who have seen the metal just explode in value over the past two years. Yet the dollar/bitcoin price has effectively been stuck at about $90,000 for the same period – a deeply frustrating development.

Jumpy as a squirrel

Another irony is that bitcoin is reputedly the more volatile asset, but recently it’s been as docile as a large ginger house cat. Gold is supposed be the dependable, reliable stable asset, but it’s been as jumpy a squirrel on espresso.

Yet, says Stanlib’s Rademeyer Vermaak, the fund manager’s head of Systematic Solutions: “There has never been a better macro environment for bitcoin.”

However, he says, “it’s obvious that the market is not yet ready to put bitcoin into the same ‘safe haven’ category as gold”.

There are lots of reasons for this, says Vermaak, starting with the fact that gold has a 5,000-year history of social acceptance, and bitcoin only started getting taken seriously about 15 years ago.

And there are other important differences: gold’s costs are front-loaded and physical. In other words, its rarity stems from the fact that getting it out of the ground is the hard part. Bitcoin’s costs are ongoing and political, in the sense that the costs vest in the energy to create them, the regulatory system to protect them, and the cost of holding them in a reliable custodial environment.

In the end, gold is an object, while bitcoin is a system.

There is also a big supply and demand reason why bitcoin has been so static (by its own very volatile standards) over the past year or so. Ironically, because of its gradual regulatory acceptance, the arrival of conventional institutional investors has provided lots of bitcoin bulls of yesteryear the opportunity to take some cash off the table.

Hedging by stealth

On the other side of the equation, gold is also being underpinned at the moment by strong central bank purchases. Gold solves a very specific central-bank problem in a world that has become politically loud, financially leveraged and strategically suspicious. It allows central banks – especially in emerging markets – to reduce reliance on a single monetary order without issuing a manifesto or provoking retaliation. It’s hedging by subtraction, not by rebellion.

Yet this divergence between gold and bitcoin might not be the end of the story. Bitcoin investors, says Vermaak, should understand and trust in the fundamental reason why they bought their crypto: there are big portability and security advantages to having bitcoin, especially in this deflationary environment.

According to Steven Sidley, professor of practice at the Johannesburg Business School, the chaos and unpredictability of Donald Trump’s administration have caused a rush to traditional hard assets which are ring-fenced from policies and political upheavals.

“Bitcoin would love to be in that pile, but is very far from a traditional asset. Its time will come,” he says.

Bitcoin becomes more “reserve-like” if four things happen:

- Volatility compresses (in other words, not just for a few quiet months but across cycles).

- Market depth and liquidity keep improving (via big, continuous, two-way markets).

- Regulatory and custody standards become harmonised.

- Political legitimacy grows (so it’s defensible for public institutions).

We’re seeing pieces of this. Institutional products like exchange traded funds help. But reserve status is the slowest club on earth. Gold got in by being ancient. Treasuries got in by being dominant.

Bitcoin will have to get in by being – above all – boring.

ALSO READ:

- Gold or bitcoin? The battle for money’s future

- The Trump trade: Gold or bitcoin?

- Gold pierces $5,000 – what’s next?

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.