To call silver’s performance a “dramatic improvement” may be the understatement of 2026, if not the decade. On Wednesday the metal topped $115 an ounce. Ten years ago, it was trading at just $12 per ounce.

No wonder, as the Financial Times reported last week, that at Texas refinery Dillon Gage, “workers are toiling round the clock to melt down jewellery, dining sets and even old dental fillings”.

“We are running three shifts, seven days a week,” president Terry Hanlon told the newspaper. “We can’t keep up.”

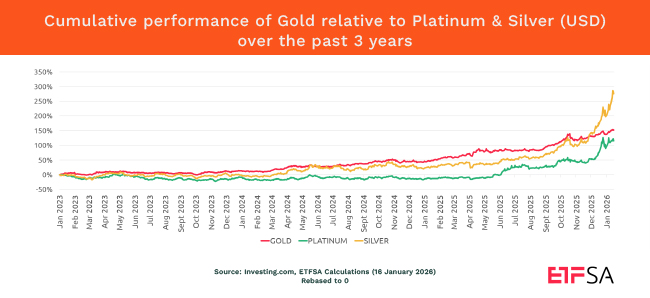

ETFSA’s Mike Brown says that thanks to this rally, silver now heads up the top performance tables for three years; it also shows up well in the five- and 10-year performance charts.

Newslv’s big year

Besides cashing in by melting down your silver baubles, you can play the silver market on the JSE via the Absa NewWave Silver Exchange Traded Note (Newslv). Absa listed the product 15 years ago, but, as Brown says with impressive restraint, the note “has only come into prominence more recently”.

According to ETFSA, the note’s market capitalisation was still only R1.7bn at the end of 2025, though that is a 201% jump on its market capitalisation of R548m as of the end of 2024.

Retail investors have been driving the gains and investors bought about $171m of the iShares Silver Trust on Monday, according to Vanda Research. In total, retail buyers have ploughed a record $921m into silver-linked exchange traded funds over the past 390 days, according to Vanda’s data.

But the market in relative terms is still tiny: silver’s trade on the London market averages about $24bn a day, according to the FT, compared with $160bn for gold.

“Unlike gold, which is widely stored by central banks, there is no silver seller of last resort when prices start to soar. And production is relatively unresponsive to price changes, because it is mostly mined as a byproduct of other metals, such as lead and zinc,” writes the paper.

ALSO READ:

- More than just a meme: Insider silver’s stonking ascent

- ETFs are bringing sexy back

- Gold pierces $5,000 – what’s next?

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.