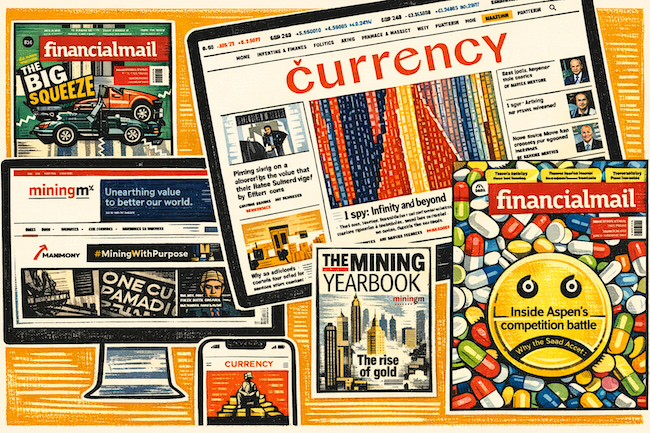

In a significant moment for South African business media, a new company called Apex Publishing Enterprises announced two acquisitions on Friday: the purchase of this platform, Currency News, as well as David McKay’s highly-rated mining news publication, Miningmx. This comes two months after Apex Capital Partners, the investment company behind the deal, purchased 70% of the Financial Mail from Arena, preventing the venerable 67-year-old title from shutting its doors.

The latest acquisitions represent a statement of intent from Apex Publishing, which will be renamed The Financial Mail Group. It marks the first major investment in the media sector in years, defying the narrative of a broader market collapse amid a squeeze on advertising revenues.

“I’ve been a major consumer of the Financial Mail, and the business media, since I was in university,” says Charles Pettit, the founder and CEO of Apex Partners, which now owns this growing portfolio of media assets. “I’ve often thought about investing in the media sector, so when I read the news about the Financial Mail closing down in October, I contacted the editor, Marc Hasenfuss, and asked him whether we could help, and we were lucky enough to be able to put together a deal.”

The FM, in particular, has been one of the few rays of light in an otherwise declining print media landscape. By the end of September, the weekly magazine boasted a circulation of 17,552 copies, including 2,851 free copies – an increase from 15,346 a decade earlier. By contrast, most major newspapers have seen their circulation decline by more than 60% over that period.

Nonetheless, Apex’s decision was unexpected, largely because the company had, until a few months ago, largely focused on industrial and mining assets, such as DRA Global, a multinational consulting engineering firm that Apex bought and delisted from the JSE last year.

Pettit says these new acquisitions represent a bet that quality financial media isn’t just socially beneficial, it can also be commercially successful.

The purchase of Currency and Miningmx, concluded last week, is part of a wider strategy to consolidate business journalism skills under one roof – the group will boast a number of former editors of the Financial Mail, Business Day, Finance Week, Daily Maverick Business, and multiple winners of the financial journalist of the year award – to enhance the depth and impact of the country’s financial coverage.

“We’re lucky in South Africa that the financial media is still producing quality journalism,” says Pettit. “I’ve been to countries on the African continent, in particular, where you see how the standard of business reporting has slipped, and this weakens the entire financial environment for consumers, investors and everyone. What we want to do here is to reinforce the quality business media.”

It seems a brave move, after a tough decade in which publishing profits have been ravaged by online news services.

But Pettit says while the media sector might be unloved, he sees opportunity. “I keep hearing people describe this as ‘brave’, but I just don’t see it like that. Media companies, I’ve always thought, could be run better and more profitably. And to be honest, I’ve seen companies in much worse shape than these publications, which have been turned around. We’ve done some basic modelling and, with a few tweaks to the revenue model, I don’t believe it will take too much to ensure we’ve got profitable and sustainable media businesses,” he says.

He cites the example of one of the companies that Apex bought out of business rescue during Covid, which had only one client: Eskom. “Over the past two years, we’ve improved that company’s processes and systems, and it’s now a resounding success. We don’t want to be investing where everyone else is – here, we’re gathering the best brands and talent, and building it into something great.”

While some publishers continue to struggle, demand for news locally still appears to be strong. News24, for instance, now has more than 110,000 paying subscribers, making it the largest subscription-led news service on the continent and demonstrating that South Africans are willing to pay for news.

In its annual report, Naspers, which owns Media24, noted that the “inhibited economy” had made it difficult for publishers, but with GDP growth expected to rise to 1.4% this year, this trajectory could improve.

Globally, the market for top-quality business news is well-entrenched. The Financial Times, which is owned by the private Japanese company Nikkei, remains the gold standard. For 2024, the last set of accounts released in the UK, the FT reported operating profit of £7.3m on revenues of £454.6m, while subscribers grew 10% to 2.83-million globally.

Positioned for recovery

Paul Jenkins, the chair of Caxton, which owns print publications including The Citizen and digital outlets like Moneyweb, believes print media still has a future in South Africa.

“There have been structural issues for local media, since big tech like Google and Facebook have hoovered up most of the advertising revenue over the past decade. But Google has, thanks to the Competition Commission, now agreed to strike a deal to compensate the media for the digital content it uses, which should make newsrooms more sustainable,” he says.

As part of this, Google is likely to agree to make annual payments for digital services to large publishers, alongside smaller grants to independent media, which it is already making.

Jenkins says this influx of cash, along with an economic recovery, should bolster advertising revenue for media companies and allow newsrooms to expand for the first time in years.

“There are no silver bullets, though. It’s about collecting more advertising money, and collecting subscription revenues. But we may be at an inflexion point, where growth in GDP leads to a revival in advertising, which should ultimately flow to the credit of media organisations,” he says.

If this happens, publications that have positioned for the recovery will be best placed to capitalise.

For McKay, who founded Miningmx in 2003, the Apex deal provides him with a new administrative backbone, while allowing him to expand the coverage at a time when interest in mining has spiked thanks to the ramp up in metals prices and excitement around big-ticket acquisitions, such as Anglo American’s merger with Teck Resources, and Rio Tinto’s courtship of Glencore.

“It leaves me exactly where I want to be. I can still run the business as I have been, but it gives me the sort of help that I really need, which removes a lot of the stress. It allows me to focus on writing the mining news,” he says. “For the past 23 years, I’ve done so much of this myself, so it’s nice to be part of a wider group now, and work alongside other journalists. I turn 60 this year, so I’d really like to build Miningmx into something that lives beyond me.”

Hasenfuss, an industry veteran, says the Apex acquisitions allow the group to build a critical mass of financial journalists who have worked well together in the past. “This is the most positive thing I’ve seen in the local media sector for a very long time,” he adds.

Currency, made up of former staffers from the Financial Mail, Bloomberg and Business Day, launched its first edition in September 2024 and had its first cash-positive month a year later.

“We see huge benefits in working together, as some of the strongest financial media brands,” says Sarah Buitendach, one of the founders of Currency. “We’ve learnt some lessons as a media start-up over the past two years, which we’re looking forward to applying as part of something new, dynamic and exciting.”

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.