South Africa mining exploration is drying up – and its clock is ticking

If there is one single statistic that says almost everything you need to know about the South African mining industry over the past three decades, it is the spending on mining exploration.

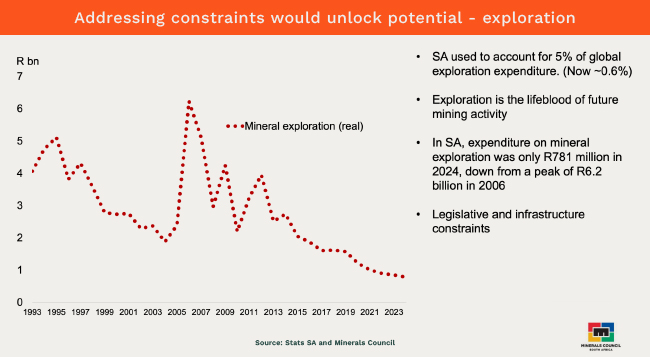

In 1995, about 5% of the annual spending on global mining exploration was in South Africa; today, it’s just 0.6%.

The reason for this decline has been well documented, including waves of regulatory uncertainty, persistent logistical problems, political vacillation, and shaky infrastructure. But this is still alarming, as local exploration has diverged from metals prices and continues to fall despite a record gold price and a resurgent market for platinum group metals (PGMs).

On Monday, the Minerals Council South Africa, which represents 90% of local miners, reported that exploration spending ebbed to R781m in 2024 – down from R6.2bn in 2006. Until 2011, it vacillated at about R3bn a year, before sliding lower, despite a rising tide of global industrialisation.

“The lifeblood of mining is exploration. Without it the mining sector has no future,” said Minerals Council CEO Mzila Mthenjane in the council’s annual “state of mining” report. “This is deeply troubling for our sector and it needs urgent attention.”

And this matters hugely, according to Paul Dunne, CEO of Northam Platinum and the council’s president, because South Africa’s economy would be a shadow of itself without a mining sector.

Economic bedrock

“The mining sector is the foundation of the South African economy,” Dunne said at the Mining Indaba on Monday. “We estimate that at least 3.5-million people’s livelihoods depend on mining.”

True, South Africa’s mining industry is far from decimated – it employs 469,000 people and contributed R439.2bn to South Africa’s GDP in 2025 – but it’s as if it has been caught in aspic: the tonnes of rock moved have stayed static, while any rise in earnings has been due to commodity prices, not new production.

The council’s figures, conventionally released on the opening day of the indaba, sketch a picture of an industry cycling through huge change. Gold, for instance, once made up 43% of the industry but it’s now down to about 10%. Iron ore, on the other hand, constituted only 3% in 1995, but it’s now 27.1%. Manganese and chrome production have also grown immensely, but off a low base.

The problem with the low level of spending is that South African mining will inevitably slip behind the rest of the world, which has been growing at break-neck speed.

Exploration is the highest-risk, highest-leverage stage of the production process, and is capital-intensive, technically uncertain, mostly done by junior companies, and often takes place years (or decades) before any actual cash is made. As a result, it is more sensitive than most to policy, regulation and investor confidence.

And, if exploration dries up, it is usually the first red flag that a country’s mining regime is becoming uncompetitive – long before production numbers fall.

Bad legislation

If you’re looking for one glaring reason why investors aren’t putting money into South African mining right now, look no further than the revised Mineral Resources Development Amendment Bill.

First released last May, it alarmed the sector, since so much of it depended on still-to-be-released regulations; it proposed permits for artisanal miners without clarifying the environmental rules around this, and the procedure for new mining applications remained vague.

Mthenjane said the council has held talks with Mantashe’s department to ensure a more “investor-friendly” law is passed. “These engagements were generally constructive. We anticipate the revised bill, which we expect to be published in coming weeks, will reflect our inputs to ensure mining attracts investment in exploration, mine development and existing operations,” he said.

If those revisions aren’t made, “we will continue robust engagements” with the government, he said.

Yet in his opening keynote address at the indaba, mineral and petroleum resources minister Gwede Mantashe hardly mentioned any of the disputes around this law, painting a picture of an industry in rude health.

He did pledge, as he often does, that the government will create a “regulatory framework that is more certain, more predictable, and more transparent – one that attracts investment while ensuring that the benefits of our mineral wealth are shared equitably with all South Africans”.

Yet the devil, as ever, will be in the detail of what is in the final bill.

No BEE in exploration

Mantashe did, however, point to the fact that the bill has already been altered from the first version to remove the requirement that exploration companies must have BEE credentials – which will boost his credibility with the industry.

“This is not a retreat from transformation, nor is it an endorsement of the misguided view that Black participation is a barrier to economic growth. It is rather a pragmatic recognition that prospecting is a high-risk phase where no economic value has yet been proven,” he said.

As a result, he said, South Africa’s renewed exploration drive is “already bearing fruit”, citing 80 applications to the Junior Mining Exploration Fund for projects involving metals such as tin, tungsten, uranium, gold, arsenic, fluorspar, lithium and the flavour of the year, copper.

However, what does little for Mantashe’s pledge of administrative efficiency is that the cadastre system – which will provide an online portal transparently laying out who owns mineral and prospecting rights – still hasn’t been implemented, after more than a decade in the planning.

Roll on the cadastre

Ziyanda Ntshona, a partner at legal firm Herbert Smith Freehills Kramer says that a functional cadastre could “unlock many benefits along the value chain, including access to data that will allow the use of AI”. But implementing such a workable system won’t be easy, he warns.

The cadastre system is only now in piloting stage, with a phased rollout under way in selected provinces. “The use of data from the cadastre system will enable more accurate exploration data and, with visibility, we hope confidence will rise. If the system works efficiently and transparently, investment should hopefully follow,” Ntshona says.

Mantashe did say that the hold-up in the rollout of the cadastre system is not preventing the department from granting new rights. The department has granted 358 prospecting rights and 32 mining rights in the past year, he said.

Helpfully, Mantashe could at least point to the fact that five mines began operating this past year. Which is good news even if, in a mining economy where the gold price has hit a record of more than $5,000 an ounce, and platinum prices have risen 74% over the past five years, you might have expected double that.

ALSO READ:

- Mantashe speaks ‘growth’ amid regret at South African mining’s ‘lost generation’

- Mantashe flashes middle finger to investors

- Stars align for mining junior Orion

Top image: Gwede Mantashe. Picture: Gallo Images/Sharon Seretlo.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.