Africa is entering one of the most turbulent trade environments in decades, with rising tariffs, collapsing aid flows and escalating geopolitical fissures reshaping the continent’s economic prospects, according to a major new report by the Boston Consulting Group (BCG) and the Africa CEO Forum.

In a sweeping 28-page assessment, Africa Unleashed: Seizing Opportunity in a Shifting Geopolitical Landscape, senior BCG partners warn that the post-1945 rules-based trade system is “unravelling”, and that African governments now face both historic challenges and an unprecedented opportunity to reposition the continent in a rapidly multipolar world.

“Volatility and uncertainty are becoming the new normal for global commerce,” write BCG senior partners Patrick Dupoux and Lisa Ivers, noting that Africa risks being “left behind” unless leaders move with “vision and urgency”.

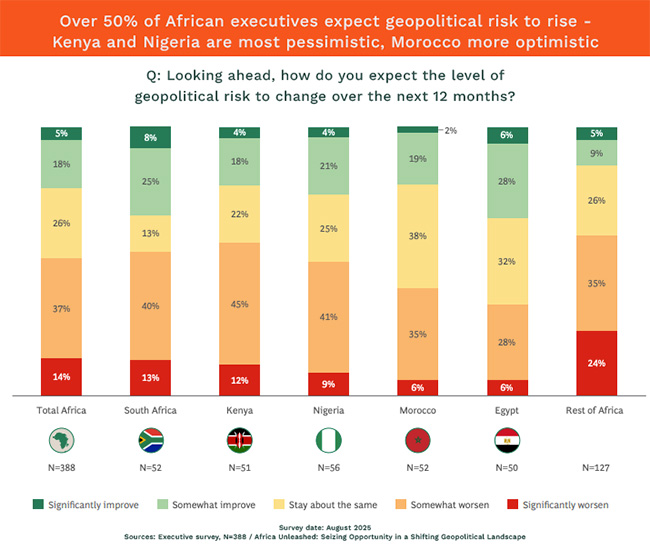

The report is notably harsher than much current analysis of the continent, and a survey of more than 350 African executives shows that business leaders are worried: 82% view global geopolitical tensions as high, and 60% report a direct negative impact on their own countries.

The South-South push

But there is also the other side of the coin. The Global South is gaining momentum, with the report noting that South-South trade is forecast to increase by 3.8%, according to BCG’s Global Trade Model, and regional GDP is projected to grow by 4.2% annually to 2029 – more than double the rate of advanced economies.

And that is reflected in the survey of executives too: despite these headwinds, two-thirds are confident of Africa’s longterm economic trajectory and underlying fundamentals. This is somewhat backed up by information from outside the report: the International Monetary Fund (IMF) is currently projecting global GDP growth of about 3.1% in 2026, slightly higher than 2025. For Sub-Saharan Africa, growth is forecast to rise modestly from 4.1% in 2025 to roughly 4.4% in 2026.

Compare that to South America, to take just one example, where the IMF is projecting growth of about 2.4% to 2.6% growth for 2026.

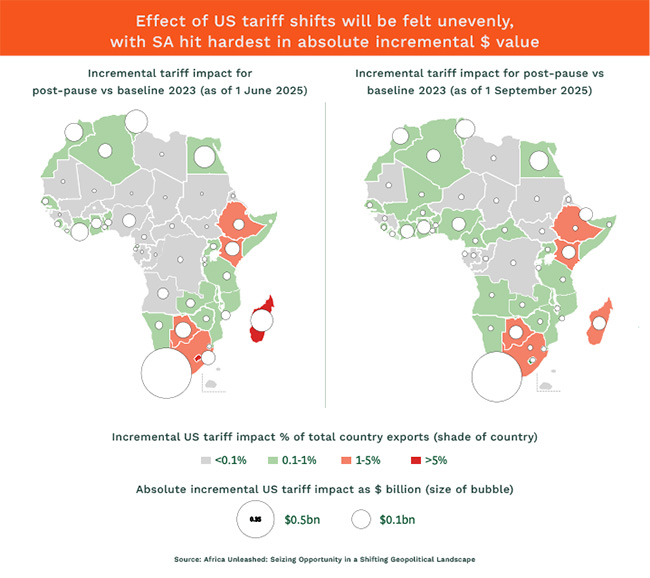

Still, the BCG report highlights some perturbing figures. New US tariff regimes are expected to impose up to $5bn in additional export costs on African economies, with South Africa absorbing more than half the blow.

By August 1 2025, Washington had implemented a 30% reciprocal tariff on a wide range of South African industrial exports, including steel, aluminium, automotive components and chemicals. The metals sector alone accounts for 38% of the projected $2.6bn hit to South Africa’s export earnings.

Punitive tariffs

“South Africa now faces one of the most punitive tariff regimes imposed by the US on any African economy,” the report states, warning that the country’s “industrial viability” is at risk.

The findings echo earlier warnings by South Africa’s automotive and steel industry associations, which argued that reciprocal tariffs would make South African industrial exports “uncompetitive almost overnight”. But they clash with more optimistic takes by some South African officials, who have insisted the tariff dispute will be “limited and temporary”. However, there is no evidence in US policy statements that the measures will be rolled back soon.

Other African states face different forms of pressure:

- Kenya risks a tariff jump from 0% to 23% on key African Growth and Opportunity Act-linked textile exports.

- Madagascar, heavily dependent on US apparel markets, could see tariffs reaching 32%, threatening one of its largest formal employment sectors.

- Morocco, by contrast, emerges as a relative winner, buoyed by long-standing free trade agreements with the US and EU, and now a preferred location for EV and battery near-shoring investments.

A second major disruption highlighted in the report concerns a historic contraction in global aid flows, with an estimated $50bn-$70bn in official development assistance now at risk globally.

This is largely due to the US dismantling of USAID, but there have been deep planned cuts in UK, Dutch, German and French aid budgets too – in some cases up to 40%.

‘Existential fiscal risk’

The report warns that cuts will disproportionately affect Africa, which receives 19% of global aid, with countries such as Somalia, Sudan, the Central African Republic and Burundi facing “existential fiscal risk”. For 28 African states, grants account for more than 10% of national financing – a dependency the report describes as “unsustainable in a more contested geopolitical landscape”.

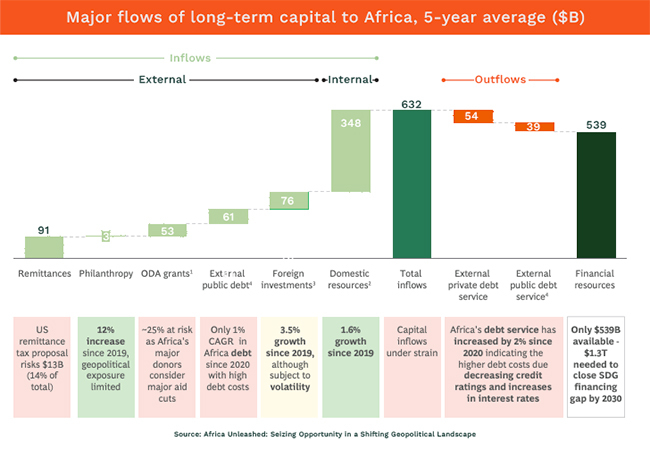

Still, and against expectations, Africa has recorded a 10% compound annual growth rate in foreign direct investment (FDI) since 2019, outperforming a world where greenfield FDI is falling. But this resilience rests heavily on just three countries – Egypt, South Africa and Mauritania – and on one sector: renewable energy.

The United Arab Emirates alone supplied $69bn in green hydrogen and renewables commitments to Africa between 2022 and 2023, including a single $34bn project in Mauritania.

Yet most of this capital is only “committed rather than realised”, while the fDi Markets 2025 report warns that several mega-projects in Africa carry “high execution risk” due to policy unpredictability, slow permitting and inadequate transmission infrastructure.

Africa’s debt story is also worsening. External public debt has grown to $688bn, with African states paying interest rates “two to four times” the global risk-free rate. China now holds 12% of Africa’s external public debt, more than any other country.

The report highlights Kenya – nearly 20% exposed to China – and Ghana, effectively locked out of capital markets, as emblematic of rising vulnerability.

Made in China

The relationship with China remains key. BCG forecasts that Africa’s trade with the superpower will grow by $173bn by 2033 – far more than with any other partner. But it warns the relationship remains dangerously skewed towards Chinese manufactured imports.

China’s June 2025 decision to eliminate tariffs for African partners maintaining diplomatic ties with Beijing is likely to expand agricultural and raw material exports – but risks reinforcing existing imbalances, with Africa exporting unprocessed goods and importing high-value products.

The UN Economic Commission for Africa has repeatedly warned that Africa risks “locking in” commodity dependence unless industrialisation picks up. The African Development Bank regularly stresses that Africa processes less than 5% of its own minerals locally.

No wonder much weight is placed on the African Continental Free Trade Area, with BCG arguing it could increase intra-African exports by 32% and FDI by 68%. The operative word being “could”: “Rules of origin are incomplete, tariff schedules are delayed, and non-tariff barriers remain the silent killers of regional trade,” notes co-author Trudi Makhaya.

The report closes with an unusually blunt warning for a consultancy document: “Africa is not waiting, but nor can it afford to. The next wave of African growth will be led by those who can align strategy with shifting global realities.”

ALSO READ:

- Africa’s big bet: $15.2bn mobilised for mega-projects

- Africa – finally boom adjacent

- Parity not charity: What Africa wants

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.