African exports to China have just exploded this year, which raises an interesting point: has US President Donald Trump’s bullying inadvertently provided the Brics+ grouping with the raison d’être it was so obviously lacking?

And it’s not just African trade with China that is booming, but African trade with India too.

A graphic demonstration of this global axis-swing – and also, ironically, its limitations – was evident this past weekend at the 2025 Shanghai Co-operation Organisation (SCO) Summit in Tianjin, which gathered together more than 20 presidents and prime ministers, and was hosted by China’s President Xi Jinping.

Major African countries are not members of the group, but several Brics members are, and most notably Indian Prime Minister Narendra Modi attended the summit in person, marking his first visit to an SCO summit in seven years, as did Russian President Vladimir Putin.

As Donald MacKay, head of XA Global Trade Advisors, tells Currency: “There is no question in my mind that Trump has done more for Brics than even Xi. He is Mr Brics. Modi and Xi are hanging out together like they weren’t beating each up with cricket bats a few years ago.”

Even more striking at the summit, The Economist points out, was the presence of leaders of countries that have in recent decades leaned more to the West, including Turkey, Egypt and Vietnam.

“Xi’s claim to lead a global coalition of America-sceptic powers is not as fantastical as you might think. Regarding trade, where all countries want predictability, China’s boast to be an anchor of stability now rings true – at least in relative terms,” the publication comments.

“The country is already the largest goods-trading partner of most of this week’s visitors, along with another 100-odd states around the world. As the Trump administration pursues a rolling campaign of economic warfare against its trading partners, China’s sins of mercantilism and state-capitalism look minor by comparison.”

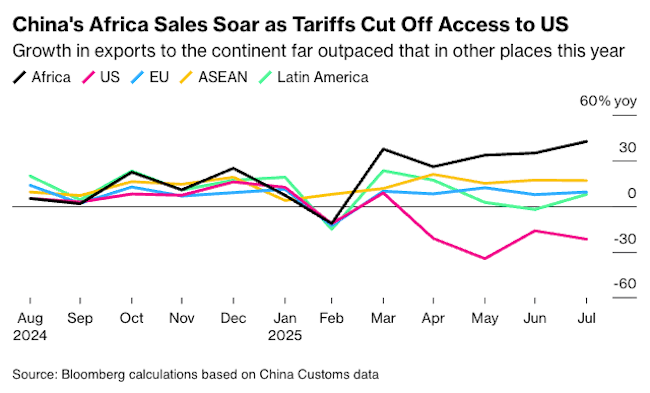

That goods-trading partnership was underlined this week with the publication by news service Bloomberg of an extraordinary increase in African/Chinese trade, which has jumped 25% to $122bn so far this year, outpacing other major markets and balancing out a decline in trade with the US.

“China’s exports to Africa so far in 2025 are more than in the whole of 2020 and on track to exceed $200bn for the first time,” Bloomberg reports. Nigeria, South Africa and Egypt are the biggest African buyers of Chinese products, but the spread is much broader following the Chinese government’s decision in June to remove levies on imports from all African nations with which it has diplomatic ties.

During the same month, the government in Beijing allowed imports of agricultural products from Ethiopia, Congo, The Gambia and Malawi, bringing to 19 the number of African countries with access to China’s market.

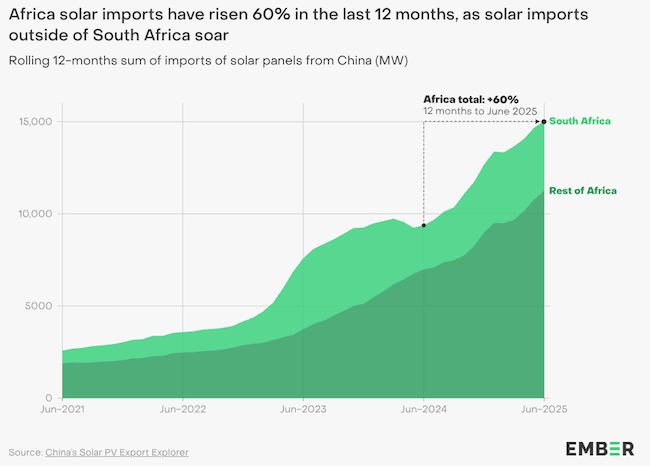

The biggest increases in product lines were construction machinery, surging 63% year on year, passenger cars more than doubled from a year earlier and, notably, solar panels, which are up 60%, according to climate think-tank Ember.

South Africa has always been a high importer of Chinese solar panels, but now the continent is taking over the baton. Over the past two years, purchases of Chinese solar panels to the continent beyond South Africa have tripled, Ember said in a report this week.

Skewed balance of trade

For Africa, there are two problems with this jump in trade. First, the increase does not improve the balance of trade; it’s still skewed heavily in favour of China. In fact, it’s made it worse: China is running a far wider surplus with Africa than last year. But with China decreasing its import tariffs on African goods, there is a somewhat better prospect of more balanced trade in the future, though that seems a long journey from here.

Historically, the trade balance between Africa and China has been very much in China’s favour: total exports into China from Africa were $109bn in 2023 compared to exports into Africa of $173bn. Both these numbers shifted up a bit the following year. This enduring imbalance reflects structural patterns: China typically exports higher-value manufactured goods to Africa, while importing primarily raw materials and commodities from the continent.

The second problem is that it’s still quite small in global terms; Africa’s trade constitutes about 5% of China’s total trade, a level that has until this year been pretty static. But it is increasing: it’s probably about 5.4% of China’s total foreign trade this year, compared to about 11% from the US.

The other issue was the function that followed the SCO: a military parade in Tiananmen Square on Wednesday September 3, ostensibly designed to celebrate the 80th anniversary of the end of the World War II.

A smaller subset of countries attended the parade, which The Economist described as “one of the largest get-togethers of autocratic regimes in living memory”, with Putin, joined by Masoud Pezeshkian of Iran and Alexander Lukashenko of Belarus, in attendance. Kim Jong Un of North Korea travelled by armoured train in his first visit to China since 2019. Notably, presidents of Congo Brazzaville and Zimbabwe also attended, but India’s Modi did not.

A new record

On the subject of India, though trade between Africa and China is large and expanding, the value of bilateral trade between India and Africa in 2024/25 also marked a new record.

Semaphore reports that India’s junior foreign minister Kirti Vardhan Singh made the announcement during an annual India-Africa business conference in New Delhi last week, saying the figure was up from $56bn in 2019/20. “India and Africa are shaping a strong partnership to co-create a shared future,” he said.

India, among the largest investors in Africa, said it wants to boost ties with the continent in sectors including health care, renewable energy and technology-driven farming.

As The Economist points out, Xi’s guestlist does not prove that China yet runs a new world order. But it does underline how forcefully the US, under Trump, is ceding influence on the continent to its strategic rival.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.