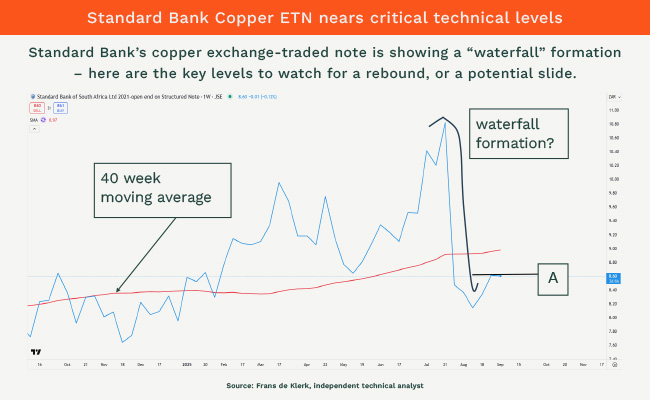

Standard Bank’s copper ETN shows signs of an upcoming shift. The chart patterns below indicate the price could either regain momentum or fall further, depending on the direction of the market.

ETNs offer a low-cost way to gain exposure to commodities like copper without owning the metal physically, making them suitable for both traders and long-term investors.

Right now, the chart points to what technical traders call a “waterfall formation”. This pattern often puts investors on edge, as it signals sharp downward momentum. But if the ETN can rise above R8.63 (line A), that would be the first sign of strength. From there, the price could push higher to R9 and potentially to R9.36.

On the downside, if it falls below R8.01, it risks slipping further. Support levels to watch include R8, R7.92, R7.84, R7.80 and lower.

Aggressive traders might consider going long above R8.63, betting that the waterfall pattern is ending. The stop-loss level to protect capital is R8. If momentum holds, upside targets include R8.70, R8.85, R9 and, over time, as high as R10.

The same strategy applies to long-term investors, but risk management is key. Above R9, sentiment improves, as this is also the 40-week moving average – a technical gauge of investor confidence. Staying above it suggests the market is more comfortable holding the ETN. Long-term investors can add exposure above this level, but should keep stop-loss protection around R8.67 to guard against reversals.

Note: This analysis reflects the personal opinion of the writer and must not be taken as financial advice.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.