Relax, says ETFSA managing director Mike Brown: neither gold nor even global stock markets are in a bubble about to burst.

This was a key message from a presentation by ETFSA last week about the year ahead for investments, in which Brown argued that there has been a “structural shift” in gold, which means the price could even appreciate from its level of about $5,000 an ounce.

It’s a controversial view, since much of the 74% gain in the gold price over the past year has been attributed to “hot money” chasing the higher price, which could easily reverse as soon as sentiment cools. But Brown, an industry veteran who worked as a chief economist at the Chamber of Mines in the 1960s and helped establish Satrix to list South Africa’s first exchange traded fund (ETF) back in 2000, said there’s no need to panic.

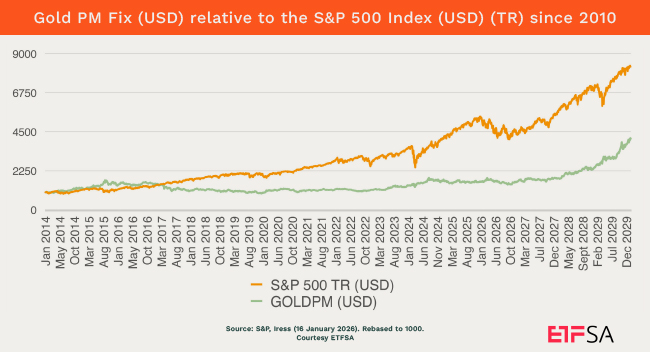

It might seem counterintuitive, given the almost daily new highs in the gold price, but if you start with 2010 as the baseline year, gold has actually underperformed the gains in the S&P 500, making the case that it still has room to appreciate.

Central banks get in on the gold action

“Gold still has to catch up to the equity market,” said Brown. “Does that mean there’s more upside in the gold market? Maybe – but the big factor is that central banks are now buying gold since they don’t trust that America won’t seize their assets. You see China and India and others buying gold and putting it into their official reserve assets.”

This means there is plenty of scope for central banks to expand their gold reserves, in preference to the dollar, which has been weakening.

In January, for instance, China’s central bank reported 74.19-million ounces of gold in its reserves, worth $367bn, having bought more in each of the preceding 15 months. Yet the Asian powerhouse held many more times that in US dollar reserves, at $3.39-trillion.

“This purchase of gold by central banks has structurally changed the gold market. It’s a new area of demand that we haven’t seen since the 1960s [when] the central banks were buying gold,” he said.

A top-performing stock market

The soaring gold price is not only set to benefit South Africa’s economy – analysts expect the country to reap an extra R100bn-R120bn in tax from metals companies this year – it also boosted last year’s performance of ETFSA’s own retirement annuities, which had loaded up to the maximum of 10% on commodities ahead of the surge.

ETFSA’s wealth enhancer delivered a total return of 25.9% last year, its wealth builder returned 24.9%, and even its conservative funds, which have a larger portion in cash and bonds, gave more than 21%.

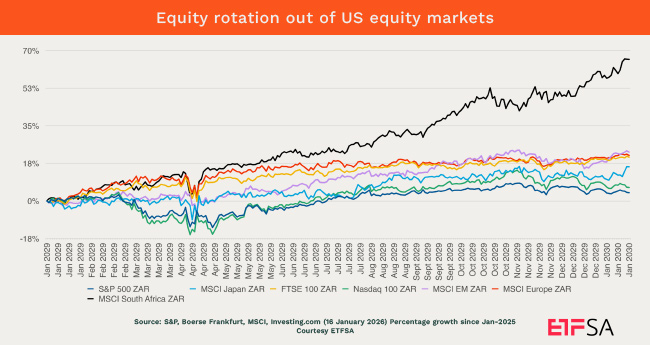

“Our stock market was one of the best-performing stock markets in the world last year,” said Gareth Stobie, ETFSA’s strategy and corporate development director, during the presentation.

“That’s part due to sentiment, and part due to reality; there’s been some really good things happening in the last while – you think of the country being taken off the greylist, the ratings upgrade by Standard & Poor’s in December, and some public reform coming through.”

If anything, Stobie is understating how surprisingly well South Africa’s investment market did last year.

In rand terms, the JSE all share index grew 43%, reflecting the recovery from load-shedding as Eskom all but stopped the blackouts, and marginally stronger business confidence. But in dollar terms, the JSE returned a world-beating 58%, as the rand’s gain against the dollar added cream to an already solid performance.

This was the JSE’s best performance in many years, outpacing global stocks, which rose 8% last year. It represents a notable turnaround since, for a number of years, global stocks outpaced the JSE – in 2024, for instance, global shares rose 21.%, compared to the JSE’s 13.4%.

This took global investors by surprise, since many had written off the country, said Brown.

“South Africa was the best-performing emerging market and [global investors] missed the boat. They’ll eventually try catch that board, and that will be good for markets, depending how our politics goes,” he said.

Overvalued stocks?

While last year’s giddying rise has prompted concerns of stocks also being overvalued, Brown said this isn’t a worry right now.

The reason, he said, is that company profits continue to rise sharply, supporting the valuations of the stocks. In the third quarter of last year, for instance, US companies reported profits of a record $3.41-trillion, illustrating that there is actual money behind those stock valuations. And this trajectory isn’t slowing yet: for 2026, the profits of companies listed on the S&P 500 are expected to grow 12%.

This means that in the US, stocks are trading on a forward price-to-earnings (p:e) ratio of about 22 right now – lower than the 28 of two years ago. “So it’s actually becoming less expensive, because earnings are growing faster than prices. And if you take big tech out of the equation, that p:e ratio is around 20 times,” said Brown.

South Africa’s JSE is considerably less expensive on a p:e of about 14 – the sort of number that is in line with other global markets, and around a level which has remained sustainable for a long time, he said.

“People are saying markets are overblown, they’re overstressed, there’s a bubble – but that’s not bubble territory. That is something that can be sustained over time. As long as profits drive markets, we’re going to stay positive,” he said.

Brown said that bull markets often continue for many years, and don’t stop simply because enthusiasm wanes.

“Markets don’t die of old age; they stop when there’s a major shock, like when banks go bust, interest rates scream up, money gets tight, or inflation gets out of control – none of that is around at the moment.”

ALSO READ:

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.