More than five years after his conviction by a US court for defrauding investors out of millions of dollars through a string of start-ups, South African Eran Eyal appears to be hiding out in Europe, leaving hundreds of investors waiting for their promised refunds.

The investors are part of a group of about 2,100 people who invested in a $42.5m initial coin offering (ICO) run in 2017 and 2018 by Shopin, a start-up founded by Eyal, who was convicted of fraud in New York’s Kings County Supreme Court in December 2019.

Some of the 2,100 investors include those who invested in Passo, a forerunner of Shopin.

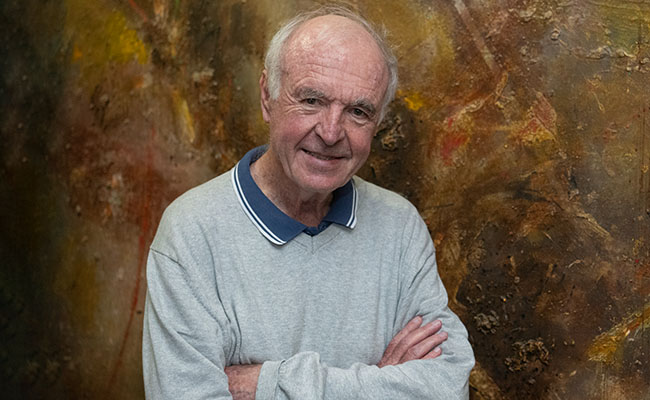

Eyal, who was born in Israel but grew up in a middle-class household in Durban, was known to be charming, self-effacing and gentle, with a head for business – characteristics he used to sucker investors from across the world.

At one point, Eyal ran a company in Cape Town called Springleap, an on-demand T-shirt printing start-up that later pivoted to a crowdsourcing platform for brands. But in 2014, he moved to New York, where he created Shopin as a “shopping rewards solution”.

Filings by the New York attorney-general said Eyal had built Shopin on a series of lies, including falsely claiming it had carried out pilots with major retailers Bed Bath & Beyond and Ermenegildo Zegna, and lied about Shopin’s blockchain.

After he was arrested in 2018, he faced up to 15 years in jail. The next year, a gaunt-looking Eyal was convicted – but other than two weeks in Rikers Island in New York, he escaped jail time entirely.

He did this by reaching a plea deal to hand over what was left of the cryptocurrency Shopin had raised of 3,105 ethereum. The attorney-general said these proceeds would be used to refund the investors.

Part of the seized ethereum, totalling $457,000, was used to refund four investors defrauded through Springleap, another of Eyal’s start-ups. The remaining ethereum was sold in 2021 for $11m, according to one Shopin investor on a Telegram channel for disgruntled investors.

Maddie Somers, the press aide for the attorney-general, told Currency the office has so far paid refunds to investors able to accept a US-based cheque. Investors have apparently been refunded 31.2% of their losses. Somers could not, however, provide the amount in refunds that has so far been paid out.

Over the next three months, she said the office would pay refunds to investors, including those who invested in Shopin as part of an investment syndicate, and who are eligible to receive payment via US-based cheques or wire transfers.

Investors continue to complain they have yet to receive any refund.

One investor, “Moonshiner”, posted on a Telegram channel for Shopin investors that he hoped investors would get the refund “before we die”. Another, called “Knight”, said “we are all suffering mental damage and PTSD, they keep living us [sic] in a state of instability by dragging us and reminding of the money we lost, while promising us, we will get it back”.

Another investor, “Piechu”, went as far as to claim that “the NYAG [New York attorney-general] exit scammed on us”.

“Bassie”, who claims he was a “larger” Shopin investor and met Eran “a few times”, told Currency via Telegram that the refund process has been “extremely slow”. Refunds have been paid in batches, he said, and have since ground to a halt entirely.

He said the cheques that some investors received haven’t been useful for many people, as most of them cannot cash US cheques and were asking to be paid by wire transfers instead.

“It seems lots of people, especially from the defunct syndicates, haven’t gotten anything,” he said, calling it a “disgrace” that investors have been waiting so long to be refunded

The Lisbon life

None of the investors have seen Eyal since he was deported from the US in 2020, he said. “Eran basically vanished. [He] was apparently seen in London and afterwards Tel Aviv.”

Back in April 2021 one investor claimed he’d spotted Eyal acting as a “community admin” for Cere, a crypto token linked to Binance. Eyal’s name was then subsequently deleted from a Cere group along with all his messages, he claimed.

Currency, however, has established that Eyal was, at last count, living in the Portuguese capital of Lisbon.

A series of photos posted on a friend’s Facebook profile since June 2021 show the bespectacled Eyal, now sporting a short-trimmed beard, and often pictured wearing a black T-shirt and fedora, on the beaches and in the home of friends in Lisbon, and even in Disneyland Paris.

These include photos posted in September 2021 of his small wedding held in Estoril, near Cascais, where he is pictured with his bride behind a white wedding cake sprouting peacock feathers.

His wife, a self-help speaker originally from California, also has a home in Lisbon, according to comments she made on Facebook.

It seems the last photograph of Eyal appears to be of him at what looks like the dinner table in a friend’s home, appearing on the same mutual friend’s Facebook profile in June 2024. It is not clear whether he is still in Lisbon or not, but his wife still lists herself as living there.

Frustrated investors may be hoping they will ultimately be able to recoup some of their funds, and put the whole ordeal behind them.

Eyal is likely trying to keep out of sight; with his fair skin, keeping out of the sun and record temperatures in Europe is probably a smart option anyway. But what he is getting up to behind closed doors is anyone’s guess.

Timm is the author of ‘At Any Cost’ (Tafelberg, 2021), which details Eyal’s fraud saga.

Top image: Eran Eyal. Picture: Francois Durand/Getty Images; Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.

I was able to recover back my USDT taken from my wallet by some malicious threat actors. Got help with (asset resolute at g-Mail)