South Africa’s economy surprised on the upside in the second quarter, but the deeper story is harder to cheer: businesses still aren’t investing, and that leaves a recovery built on sand.

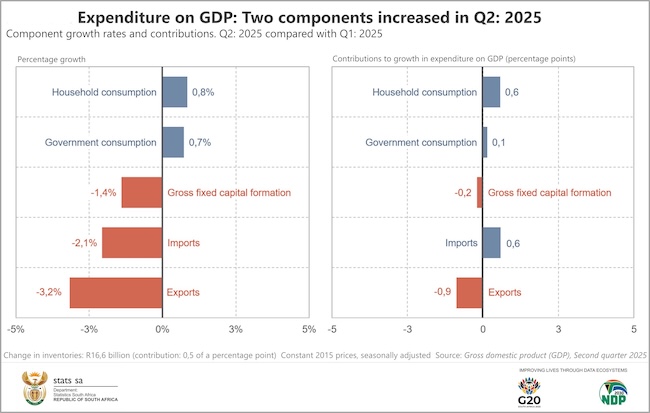

GDP grew 0.8% between April and June, up from 0.1% in the first quarter, according to Stats SA. It’s the quickest pace in two years (believe it or not) and beat the 0.6% median estimate of 13 economists in a Bloomberg survey. Mining, manufacturing and trade provided the lift, alongside firmer household spending and inventory restocking.

Yet gross fixed capital formation shrank by another 1.4% – the third straight quarterly decline. This measure, covering spending on machinery, buildings and equipment, is the lifeblood of future growth. Its erosion points to subdued confidence and a private sector unwilling to take risks.

“The persistence of low investment, despite some expectations for improvement, is especially concerning,” says Casey Sprake, economist at Anchor Capital.

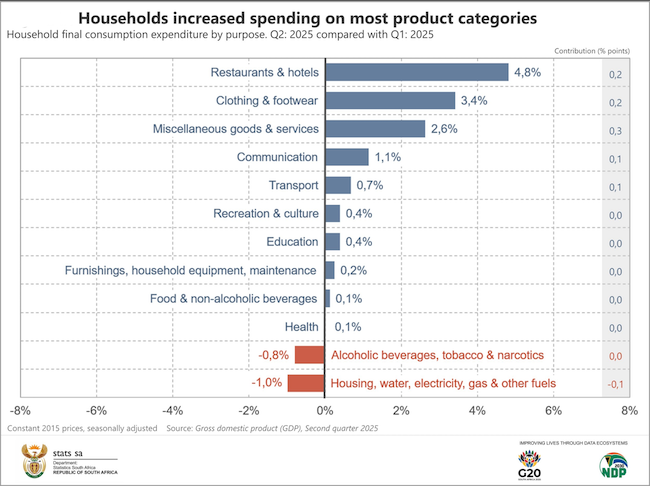

For now, households are carrying the load. Consumption rose 0.8%, extending a five-quarter run. Restaurants, hotels and clothing led the way, while insurance outlays climbed as consumers sought protection in an uncertain climate. But this resilience masks strain. Jobs remain scarce, wages are weak, and families are cutting back on essentials like utilities to fund small luxuries.

The investment picture is still harsh. Non-residential buildings, transport equipment and “other assets” all slumped. Residential construction fell for a fourth consecutive quarter.

“Households continue to spend and inventories are being rebuilt, providing near-term support,” Sprake notes.

However, exports fell 3.2% in the quarter, dragged down by base metals, vehicles and agriculture, pointing to the structural constraints that weigh on the economy. Imports fell 2.1% on weaker demand for machinery and chemicals. With US tariffs on South African goods – especially autos – set to bite, the external backdrop looks tougher still.

The outlook is hardly reassuring. Nedbank sees GDP growth of just 1.2% this year, while the Reserve Bank has cut its 2025 forecast to 0.9%. The RMB/BER business confidence index shows only 39% of firms are satisfied with conditions – a level consistent with an economy muddling along at barely 1%.

Households may get some relief from lower inflation, modest rate cuts and two-pot retirement withdrawals. But for the broader economy, the message is blunt: without investment, there is no durable growth. As Kevin Lings, the chief economist at Stanlib, South Africa’s second-largest asset manager, points out, if companies don’t invest in maintaining their operations, which is happening, that capacity is eventually lost, and, in most cases, is gone forever. Just as has happened at state-owned companies and municipalities.

“South Africa can deliver short-term recoveries even against a difficult global backdrop,” says Maarten Ackerman, chief economist at Citadel. “But lasting growth depends on unlocking fixed investment and translating reforms into tangible activity.”

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.