The recent jump in the copper price has underlined just how crucial, both for industrial and diplomatic reasons, the refurbishment of the Lobito Corridor has become. This is the name given to the revival and extension of a 100-year-old railway line that runs through central Angola to the Democratic Republic of Congo (DRC) and Zambia.

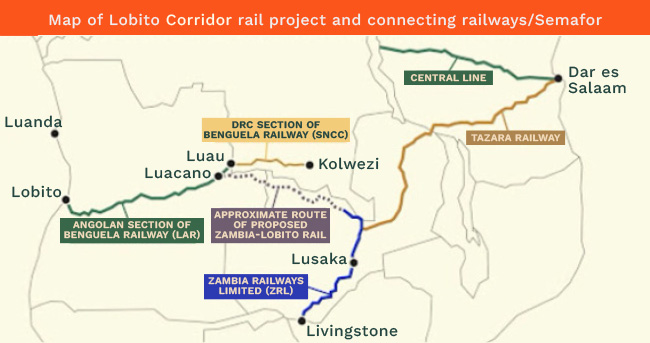

The project cost is just enormous – about $10bn. No wonder: the rail corridor will refurbish the historic Benguela Railway, built between 1902 and 1931, which stretches about 1,300km from Lobito on the Angolan coast to the DRC border, with a 400km extension into Kolwezi in the DRC, and planned spurs into Zambia.

Kolwezi is a key component of the DRC’s copper and mining industry, and the Zambian spurs will cross almost the entire Zambian copper belt.

The project is being funded by the EU, US, African Development Bank, African Finance Corporation and G7 Partnership for Global Infrastructure & Investment. But the big money is coming from the US – at least 40% of the total.

That alone makes the project something of a mirror image of the Chinese Belt and Road Initiative (BRI), from which Angola benefited extensively in the past, but which has declined in importance recently as African governments have strained under repayments for projects with sometimes dubious financial logic.

Ironically, a big slice of the BRI investment in Angola was previously devoted to the Lobito corridor. The Financial Times reports that in 2005, Angola accepted $1.5bn in Chinese finance to upgrade the railway and the port of Lobito. The work was completed by the China Railway 20th Bureau Group Corporation about 10 years ago mainly using Chinese labour – a typical feature of Beijing’s infrastructure projects in Africa at that time.

Yet the line was barely used. “What Angola failed to achieve over the years until now was to find an economic and financial model for the viability and activation of the corridor,” the FT reported last year.

All that has now changed, dramatically – thanks to copper and cobalt. The global need for both minerals has made the central African mines “enormously prospective” – even the old mothballed Zambian copper mines that were built by Anglo American, nationalised and subsequently reprivatised.

US commitment

The new line is designed to be open-access, serving both freight and passenger traffic, and is managed under a 30-year concession by a consortium led by Swiss trader Trafigura, the Portuguese construction group Mota-Engil and the Belgian railway specialist Vecturis. It will reduce the transit time from about 30 days (via Beira/Durban) to under eight days via Lobito.

Ivanhoe Mines has committed to shipping 120,000-240,000 tonnes per annum (tpa) of copper concentrate starting this year under a term sheet agreement, while Trafigura’s Lobito Atlantic Railway has also reserved capacity for up to 450,000 tpa of copper exports. KoBold Metals (via the Africa Finance Corporation) has signalled plans to ship 300,000 tpa of copper from its Zambian Mingomba project once connected.

How much is riding on the effort is illustrated by the fact that former US president Joe Biden visited Angola late last year as one of the final foreign policy moves of his administration. It is indicative of Angola’s new foreign policy position, which aims at being even-handed in its global affiliations.

But it remains something of a tricky diplomatic context, partly because one of Lobito’s key customers is Kamoa-Kakula, one of the world’s largest copper mines. Kamoa-Kakula is a joint venture between Toronto-listed Ivanhoe, China’s Zijin and the DRC government.

Or maybe not; despite the championing of the project from the Biden administration, it has received express support from Donald Trump’s administration too, despite huge cuts in the US’s African aid budget. News website Semafor reported in April that a statement posted on X by the US state department claimed Washington “remains committed” to the project, which it “feels is very important”.

It’s no wonder: copper prices are currently almost double what they were in 2021.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.