Investec CEO Fani Titi clearly didn’t get Jonathan Oppenheimer’s memo that the UK is “uninvestable”. Instead, the bank under Titi is doubling down on mud island, gunning for a bigger slice of the corporate middle market in that country.

It’s a critical strategic play for Investec, South Africa’s fifth-largest bank, which has made its name in corporate and private banking, but which is reaping the whirlwind of being exposed to two of the most plodding economies in the world: the UK and South Africa. The extent to which this has hamstrung the bank was evident in its financial results for the six months to September, which showed a 2.6% fall in its operating profit to £527.4m, while its return on equity fell to 13.6% – at the lower end of its range of between 13% and 17%.

Clearly Titi’s bank needed new plans – and at the results presentation on Thursday, he spelt them out: dedicating more of Investec’s transactional services to businesses with a turnover of between R30m and R1.5bn. Targeting this “extremely profitable” part of the commercial banking market will turbo charge its profits, adding “at least” 200 basis points to the group’s return on equity by 2030.

Investec aims to scoop up 1,000 of the roughly 60,000 mid-sized businesses in the UK by 2030. In South Africa, it is perhaps more ambitious, looking to increase the size of its corporate customer base 70% by 2030, from 3,000 to 10,000. But is this doable, particularly in light of what Oppenheimer, whose family founded Anglo American, said at the Bloomberg Africa Business Summit this week?

“So long as the UK takes 30 years to do a nine-month project, it’s uninvestable,” he said, referring to estimates that this is how long it would take to turn a 29km stretch of road into a dual carriageway.

In response to Currency’s question on Oppenheimer’s view, Titi hedges his bets.

He says the UK could “do with more certainty and more pro-business and pro-growth policies” from chancellor Rachel Reeves in next week’s budget, but adds that Investec is not discouraged. “We are niched, close to our clients, and they continue to be active. If you look at the performance of our business over the last two or so years, you’ll find that the contribution from a profit perspective is almost 50% of the whole.”

Fingers crossed that this works, because investors were less than charmed by Investec’s lacklustre half-year results, pushing the shares down 5.1% on the JSE.

The results were “as expected”, says Mark du Toit, a portfolio manager at OysterCatcher. “But I like the idea of bringing their private banking experience to business banking clients.” The bank’s timeline – aiming to hit these goals in five years’ time – is “a bit unexciting”, Du Toit says, but adds that “this does at least answer the question, ‘where will growth come from for Investec?’”

Asked why it will take five years to hit its UK targets, Investec’s investment banking head Nick Riley tells Currency that the country is a number of years behind South Africa, and it will take more than a year to roll out a full product set, and cost it more than £20m.

“The timeline is fair. And [the bank] operates within certain niches. So while 1,000 out of 60,000 [companies] might seem small as a percentage, the impact from a revenue and profit perspective will materially contribute to the group,” he says. Corporate business is a money spinner though, as was evident from the fact that this niche brought in R1.7bn in revenue in South Africa, while only marginally increasing costs, which grew 1.5% over those six months.

Shunning AI bots

Investec, interestingly, is going against the grain by embracing (expensive) people at the other end of a phone line to help its customers, rather than an AI-enabled chatbot.

But in a world of chatbots, being able to phone your banker at midnight with a problem – and have someone answer – feels like something of an old-school revolution. Cumesh Moodliar, who heads up the bank’s South African business says this is fundamental to its strategy. “There are no business hours – you will have someone available to you 365 and you’ve got a high level of service,” he says. “A lot of the incumbent banks have reduced the size of their footprint, but many people still like the idea of walking into a bank and knowing the branch manager.”

The catch, however, is that a bank’s technology must be as good as that of its rivals, even if it puts the emphasis back on human skills. It’s a big bet –especially for a bank that is hardly shooting out the lights. But Moodliar argues that the bank’s growth is better than these results suggest. In South Africa, he says, it grew the number of private clients by 9%, while its retail deposits grew 10%.

“We’ve seen very good lending book growth in a declining interest-rate environment. You’ve had a negative interest-rate endowment, and very competitive market pressures, but all the key earnings drivers are in the right direction,” he says.

If, fingers crossed, South Africa’s GDP growth can emphatically breach 1%, then the bank is well placed. It’ll help, of course, that ratings agency Standard & Poor’s raised the country’s sovereign rating by one notch last Friday. That’s a big deal, says Moodliar – even though it’s not where the country needs to be.

“Many asset managers that we talk to will only start reallocating funds to South Africa once you’re back at investment grade,” he says. Still, the ratings upgrade could be a catalyst for wooing new foreign direct investment – and lowering the cost of capital for companies.

“It starts to show a positive trajectory [and while] we are still two notches below investment grade, as soon as we can get back to investment grade you start attracting emerging-market mandates into South Africa.”

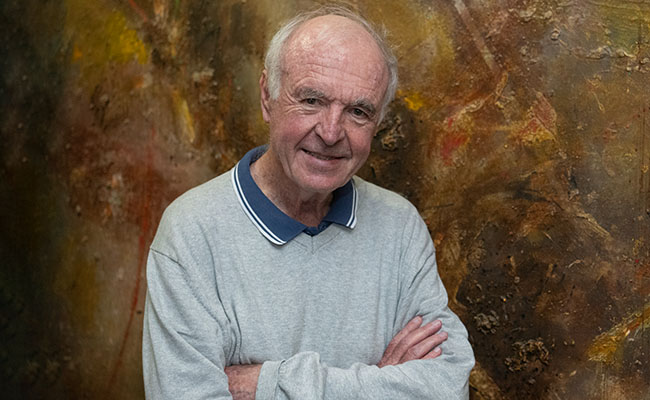

Top image: Invested CEO Fani Titi. Picture: supplied.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.