Sadly, most South Africans are more familiar with gambling than with saving or investing – a sorry statistic reflected in our dismal negative household savings rate of -1.1%.

That’s partly due to the harsh economic environment, but when households spend a large chunk of their income on gambling, they’re compounding losses instead of returns. They’re missing out on the quiet magic of long-term investing – and I’d bet my last rand that few gamblers have outperformed the Nasdaq 100’s 13%-14% annualised return over the past 30 years.

So why roll the dice for that elusive jackpot? Investing can be as hands-on or as passive as you like. You can kick back for the most part by buying a basket of low-cost index funds and letting time do the heavy lifting.

The National Gambling Board’s latest report shows just how deep this habit runs. Between April 2023 and March 2024, South Africans spent R1.1-trillion gambling, with gross gambling revenue up 26% to R59.3bn. That’s a lot.

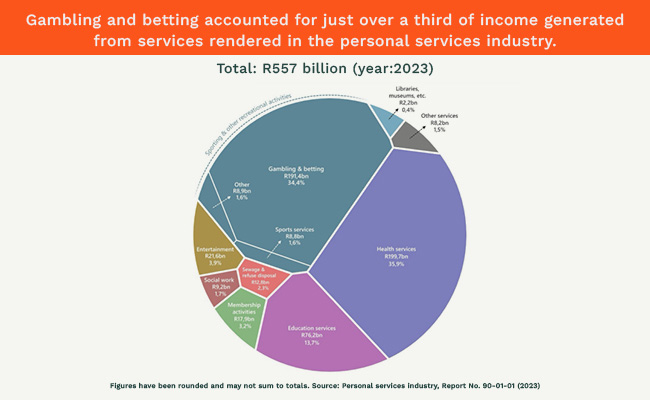

This isn’t just the occasional lottery ticket – and those staggering numbers don’t even account for informal gambling. Stats SA says gambling is now among the biggest revenue generators in the personal services industry – rivalled only by health, and eclipsing education, entertainment and social services.

No wonder our savings ratio – the share of income that households set aside rather than spend – is among the world’s worst. South Africa peaked at just 1.6%, compared with 3.5% in the US, 5% in the UK and 11% in Germany. Even our emerging-market peers, such as Brazil (3%), India (8%) and China (30%), leave us far behind.

Every rand punted away is a rand that is not compounding towards your future. And over time, the opportunity cost becomes enormous.

Over 30 years, R100 in the Nasdaq 100 could have grown to R10,000 – or at least R5,000-R7,000 under more conservative assumptions. That’s the power of compounding. On the other hand, gambling is a habit that drains wealth instead of building it; imagine the intensifying effect of the money being sunk into the Lotto, sports bets or slot machines being diverted into the financial system.

Yet, some still see investing as just another gamble. And, yes, not all “investing” is the real thing. Some of it is barely distinguishable from gambling and is just dressed up in smart-sounding terms like “speculation”. If you’re putting half your savings into meme stocks, non-fungible tokens or risky trades on the rand/dollar exchange rate based on a “gut feeling”, that’s not investing, that’s wagering. Even a lot of crypto trading still sits squarely in the speculative camp.

Tilting the odds

So, what is true investing, then? Benjamin Graham, widely regarded as the father of value investing and a mentor to Warren Buffett, defined it in his book The Intelligent Investor as an approach that protects your original money (your capital) while growing it steadily over time. In other words, it offers relative safety and stability – with fewer nasty surprises.

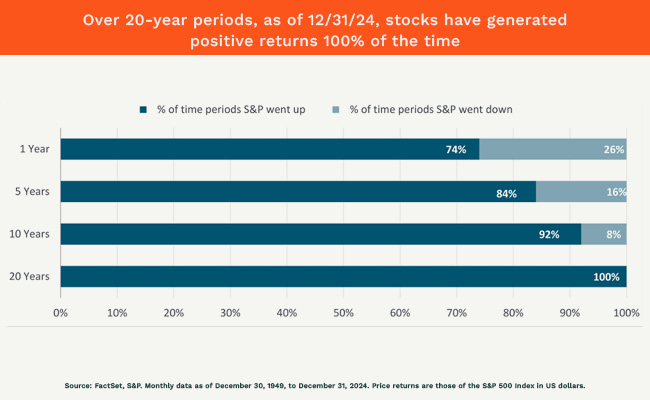

Real investing tilts the odds in your favour. With diversification, discipline and time, your probability of success rises. According to FactSet and S&P data, over any 10- to 20-year period since 1949, the S&P 500 delivered positive returns in 92%-100% of cases. While money can also be lost investing, the longer you stay invested, the better your odds – the exact opposite of gambling, where time works against you.

You don’t have to sit at a slot machine for hours or pick the right horse to build wealth. You can make money while you sleep – by owning shares in real companies selling real products, compounding real profits.

Better yet, if you can’t beat the gamblers, invest in them: companies like Robinhood, DraftKings or traditional casino operators let you monetise speculation from the other side of the table.

So don’t bet on luck. Bet on time, patience and a plan. That’s how you win the long game.

Jordan Toy is a private wealth manager who specialises in constructing and managing portfolios with a long-term investment philosophy rooted in business fundamentals and human behaviour.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.