Occidental Petroleum is an energy and chemical company listed on the New York Stock Exchange, which recently sold its petrochemicals business OxyChem to Warren Buffett’s Berkshire Hathaway for $9.7bn – all cash. The deal was partly a bailout for Occidental, which needs the money to slash its debt and fund its ambitions to become an oil major. Berkshire itself now owns about 27% of Occidental.

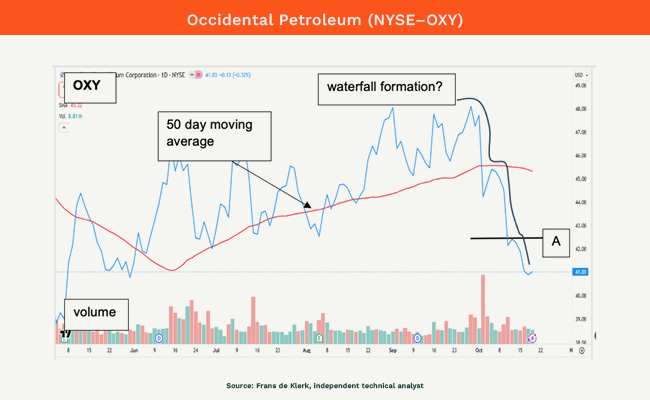

The recent jump in volumes has caught our eye. Buyers will be happy above $47.92, but the potential waterfall formation evidenced on the chart may be holding investors back.

Above $42.87 we see the first sign of technical strength, while below $41 the share could slide to a low of $36.89.

For traders: buy, or consider a long position above $42.87, if you believe that the waterfall formation may come to an end, but use $39.10 as a stop loss to protect capital.

For medium- to long-term investors – do the same as the traders but also use the stop loss as given to them. The 50-day moving average (the red line, $45.35) is a great barometer to measure investment sentiment. Above the average, which we regard as a resistance line, investors are happy to invest; below the average, investors may be nervous towards the share.

The views reflect the opinion of the writer and are not to be construed as financial advice.

Frans de Klerk is an independent technical analyst.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.