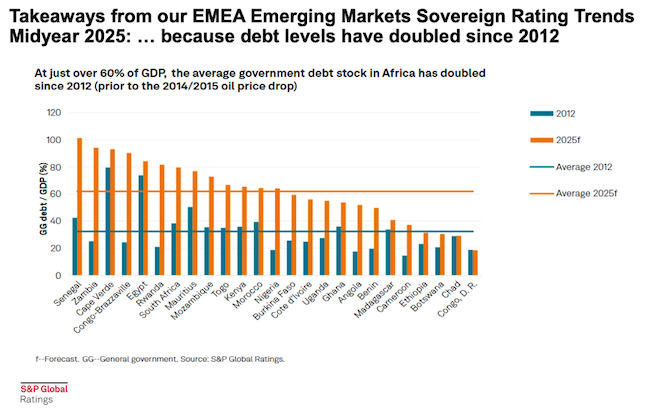

While Africa’s sovereign credit ratings have deteriorated over the past decade – mainly due to a doubling of debt levels since 2012 – the continent is showing resilience amid global economic headwinds, according to S&P Global.

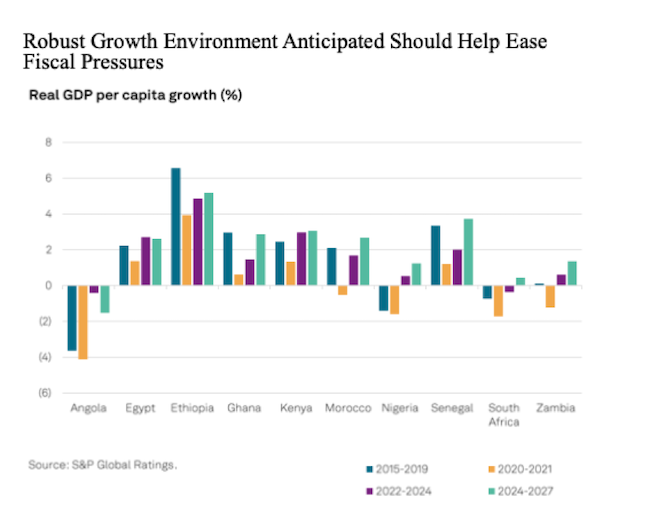

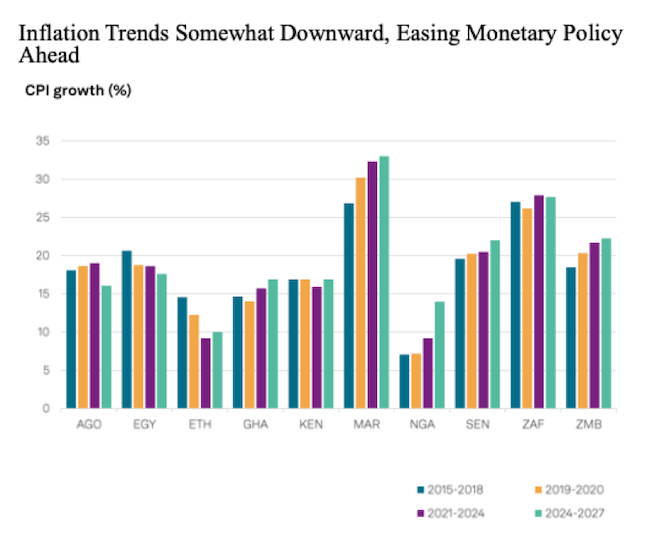

The region is experiencing broadly positive economic growth, accompanied by easing inflation, Ravi Bhatia, S&P Global’s lead analyst for African sovereign ratings, said in a presentation on the firm’s mid-year assessment of the continent.

Describing the tactics being used by US President Donald Trump’s administration on geopolitical issues as “innovative/unconventional”, Bhatia cautioned that the global backdrop is increasingly volatile, with trade tensions, US aid cutbacks, and financial tightening looming large.

He pointed to Washington’s sharper scrutiny of policies, such as South Africa’s new land expropriation law, alongside uncertainty over trade agreements like the African Growth and Opportunity Act (Agoa), which grants duty-free US market access to thousands of African products.

“In theory, Africa is lower down on the list of priorities for the US,” he said, “but we have already seen South Africa’s new expropriation law come into sight, while Lesotho’s textile exports have been severely hit by tariffs.”

Lesotho’s textiles and garments industry – the country’s largest private export earner and employer – faces collapse as the US prepares to impose 50% tariffs from August 1, the highest of any country. Several factories have already closed since the measures were first announced in April, prompting the government to declare a state of disaster earlier this month to fast-track emergency support and prevent further job losses.

The report comes as African policymakers grapple with rising global borrowing costs, trade protectionism under Trump, and ongoing debt restructuring talks in countries such as Zambia, Ethiopia and Ghana.

Debt levels across the continent soared as governments took advantage of low interest rates following the global financial crisis to tap into demand for high-yielding Eurobonds. Increased infrastructure spending also led to a surge in bilateral loans – particularly with China.

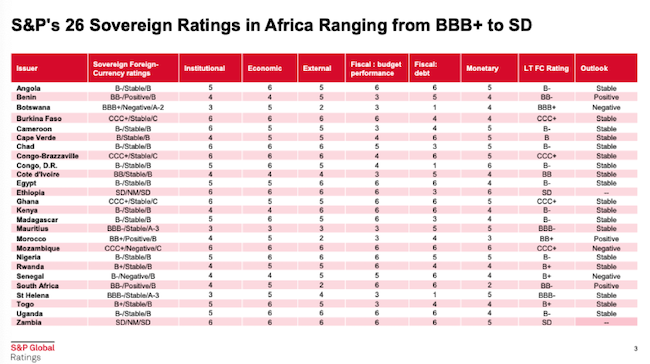

As a result, sovereign ratings in Africa now sit, on average, two notches below where they were a decade ago, Bhatia said.

Countries on the continent would also be affected through changes in commodity prices and shifting trade channels, he said.

This year has been mixed for commodity prices: oversupply has weighed on oil, grains and coal, while geopolitical tensions, tariffs and infrastructure demand have boosted metals, particularly copper, and precious metals such as gold and platinum.

Oil exporters are “somewhat struggling” in the face of mid-level global oil prices and volume pressures, he said.

On the other hand, growth is recovering somewhat in key African economies, including South Africa, albeit at low levels, and also in Nigeria.

That rebound is being helped by a moderately downward trend in inflation, which could allow room for lower interest rates, Bhatia said.

A likely increase in trade protectionist policies among major economies will hurt GDP growth in most emerging markets over the next couple of years, he said, though the magnitude of the impact will depend on the details of those policies, which will become clearer in the coming months.

Despite these pressures, S&P’s midyear outlook suggests African economies are weathering the storm better than in previous cycles. Most ratings remain “stable”, Bhatia said. A stable rating indicates little likelihood of an imminent upgrade or downgrade.

Still, S&P Global sees the risk of worse-than-expected outcomes as high, he said. This could be due to a possible tightening of financial conditions, such as higher interest rates, reduced access to loans, or stricter borrowing terms for African governments and companies.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.