Uncertainty is one of the most frequently used words in the investment world. It is also one of the most useless. While the word correctly reinforces that investment outcomes are never guaranteed, in practice it can be an expensive and costly distraction.

At its best, it is a statement of the obvious. At its worst, it triggers a specific type of paralysis that leads to missed opportunities and capital losses.

There has never been a day in the history of public investment markets characterised by “certainty” where every variable behaved as expected and outcomes were predictable. It is a crutch used in financial newsrooms, articles and webinars to describe the “now”, but as a descriptor it offers no value. If the world is uncertain all the time, then highlighting it today tells us nothing new about how to manage a portfolio.

The inbox of anxiety

The word is everywhere. A cursory search for “uncertainty” in my own inbox returns a deluge of updates, insights and forecasts. They remark on “geopolitical uncertainty”, “policy uncertainty”, “trade uncertainty” and, my personal favourite, “navigating periods of uncertainty”.

This is a case where something as innocuous as vocabulary can have a real, damaging impact on the journey of wealth creation. If you wait for the headlines to calm down, you are essentially waiting for the world to stop turning. By the time the updates in your inbox turn optimistic, the market has likely already priced in the recovery.

The myth of the all-clear signal

Investing is, by its very nature, an act of faith. We commit capital today based on incomplete information and an imperfect understanding of how unknown future factors might impact our returns.

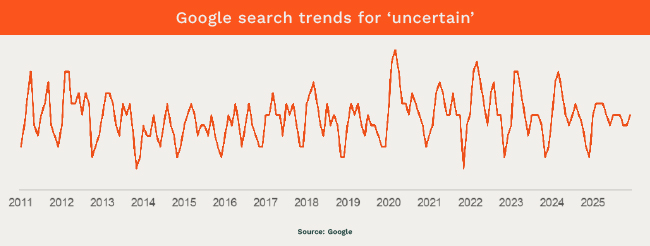

Of course, some periods feel more unstable than others. We can point to trade disputes, geopolitical flare-ups, or most of Donald Trump’s term in office as high-water marks for anxiety. But as the chart below illustrates, public interest in “uncertainty” fluctuates constantly. The danger lies in the assumption that we should wait for these spikes to subside before acting.

A better way to view this scale is as a measure of opportunity. The more uncertain the environment feels, the more likely it is that assets are being mispriced by the fearful. By the time the dust has settled and the headlines turn calm, the discount has almost certainly vanished.

Macro paralysis

This isn’t just a debate about vocabulary: the overuse of this term has real behavioural consequences. How many investors have sat on the sidelines, waiting for a clearer picture to emerge on interest rates or elections, only to miss out on the compounding power of a rapid market recovery?

This paralysis usually stems from an obsession with macroeconomics. While the “big picture” matters, it is rarely an area where an individual investor can gain a competitive edge because it is inherently so unpredictable.

Successful long-term investors don’t profess to have any marked skill in this area and often take a bottom-up approach instead. They focus on identifying high-quality companies with durable management teams that can weather most storms or overcome unforeseen obstacles better than the next company. As the famously successful investor Peter Lynch remarked: “If you spend more than 13 minutes analysing economic and market predictions, you’ve probably wasted 10 of them.”

Volatility is not uncertainty

It is worth pausing to distinguish two terms often used interchangeably: uncertainty and volatility. While these are certainly similar, they are not the same thing.

Volatility is the degree to which stock prices fluctuate. It tells us that movement is happening, which is often when the best opportunities are created. Uncertainty, however, simply means we do not know the outcome for sure. In an investment context, volatility is the price of admission for long-term growth, whereas uncertainty is just a permanent condition of being alive.

Is your portfolio managing you?

Caution is a healthy trait as it encourages us to really kick the tires on an investment and question our assumptions. But remarking on how uncertain things are is waffle that contributes nothing to the disciplined process of wealth creation.

Waiting for the dust to settle is a fallacy because the only perfect time to invest is visible in hindsight. The real work of an investor isn’t attempting to accurately predict the macro cycle, but in deciding what they want to own and being clear on why they want to own it. Waiting for the all-clear isn’t being cautious, it’s just an expensive excuse for inaction.

ALSO READ:

- The four rules of investing (and why simple is so hard)

- Are today’s ‘safest’ equity bets tomorrow’s risks?

- Investing vs gambling: The house can’t beat compound returns

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.