Whenever US president Donald Trump makes his now monotonous (but menacing) tariff threats, the equity markets tend to react with scepticism. But one market that decidedly did not was the copper market, which just exploded. Why?

Last week when Trump said he would impose a 50% tariff on copper imports into the US, the price jumped 13% – its largest single-day surge in recent history. Trump also announced tariffs on imports on a whole bunch of countries, but the equity markets stayed flat.

And the spot copper price has remained more or less at the $5.50 per pound level since then. What explains the difference between its reaction, and that of the general market, and what are the consequences?

The first issue is whether, like many of the market traumas we have seen over the past six months, this issue is likely to fade. Stanlib Asset Management equity analyst Anwaar Wagner doesn’t think so. “It is in line with what we saw with aluminium tariffs, that caused prices in the US to trade at a premium towards the level of the tariff imposed,” he says. “The US is a net importer of a number of commodities and thus these tariffs are reflected in US prices specifically.”

One of the big differences between Trump’s periodic tantrums involving trading partners – he recently threatened to impose 100% tariffs on Russian imports if Russia doesn’t agree to a Ukraine peace deal within 50 days – is that these are subject to negotiations and, in the past, have been much reduced. Trump has made numerous tariff threats — many of which were later watered down, delayed or abandoned.

With the commodity markets, there is no counterparty. Markets have learned to discount Trump’s tariff threats – except when they’re credible and specific.

There is also historical context. During the 2018-2019 US-China trade war, copper consistently dropped on tariff headlines, while US stocks were volatile but resilient.

The copper market is a very deep market, but it’s nowhere near as deep and wide as equity markets. And importantly, because copper is used in power generation and transmission, telecommunications, electronics circuitry, and countless types of electrical equipment, it’s something of a broad economic bellwether.

A tight market

The biggest issue, however, is copper supply.

“The outperformance of copper over other commodities is already an indication of a tight market,” says Wagner. Inventories on the global exchanges have been on a downward trend since 2012 and can be considered as low, he says.

“A further material drop in inventories as seen prior to the global financial crisis in 2008 could cause prices to rise further. In addition, low treatment/refining charges indicate a relative shortage of copper concentrate.”

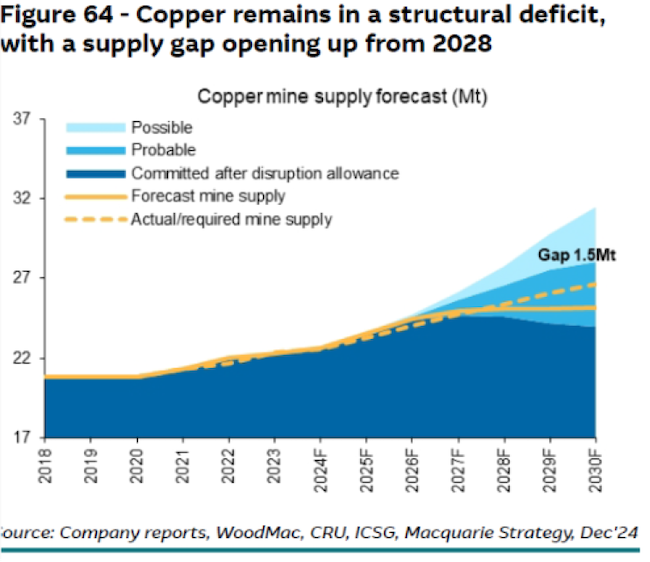

Macquarie forecasts deficits from 2028. Consultancy McKinsey forecasts a deficit of 3.6Mt (approximately 10%) by 2035, with demand growth of 2.4% but supply growth of only 1.3%. Wagner sees supply as lagging (due to a lack of large-scale quality projects and difficult operating environments), with demand bolstered from varying sources, such as ESG (renewables and electric vehicles) and now defence spending.

In other words, think Tesla electric vehicles in the US, defence spending in Europe, and renewable energy spending globally. All of these make demand more robust.

“Copper prices are therefore likely to reach new records,” he tells Currency.

One of the interesting aspects of the recent movements in the copper market is the big difference between the prices in the futures markets around the world. Wagner points to the fact that the Comex price in the US recently traded about 30% higher than London Metal Exchange (UK) prices.

That may indicate the market believes that a tariff rate lower than 50% will be applied, he says. The increase is likely to make US production more costly relative to its peers (think Boeing, which pays more for copper, aluminium and steel versus Airbus. Similarly, Tesla’s US plant will have to pay more for copper, aluminium and steel versus its German or Chinese plants).

Even by the standards of modern criticism of Trump’s tariff traumas, the commentary on the proposals has been brutal. The editorial board of The Wall Street Journal, hardly a fierce Trump critic, said this: “President Trump likes tariffs for their own sake, and the latest evidence is his bewildering decision to slap a 50% tax on copper imports. How this will help the US economy is a mystery, even as it has sent the copper market into turmoil, with chaotic results for American manufacturers that use the vital metal.”

A ‘frenzied transfer of metal’

Meanwhile some of the trading companies are absolutely killing it because of the lucrative arbitrage opportunity provided by different prices. The Financial Times reports that Trafigura, Mercuria, Glencore and IXM could rake in more than $300m in profit after shipping record amounts of copper into the US ahead of tariffs on the metal.

Tom Price, an analyst at Panmure Liberum, told the newspaper that the “frenzied transfer of metal from everywhere outside the US into the US” had made copper “the most emotional metal market going right now”.

Trump’s tariff proposal has one clear fan: the billionaire founder of Ivanhoe Mines, Robert Friedland, who said last week: “I commend the Trump administration for doing what’s obvious and intelligent – America needs to produce the metal.”

His argument is that copper is a “paradigm” for the critical minerals crucial to national security, with US dependence on imports a major vulnerability.

Yet the cold fact of the matter is that it will take years to bring on new supply in the US, which imports more than 50% of its copper. It cannot thus produce enough on its own to meet its needs. No wonder the market’s emotional.

This article was produced in partnership with Stanlib.

Top image: Getty images/Monty Rakusen.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.