South Africa’s mid-term budget tightens the screws while guarding against a collapse in economic growth. Debt will stabilise, but the decline is slower than the National Treasury projected in March. Meanwhile, lower bond yields, stronger tax collections and front-loaded infrastructure spending provide some breathing room.

The main risks remain: tepid economic growth, fragile state-owned companies and overstretched municipalities. Yet, a growing primary surplus, easing debt-service costs and a concerted push on reform in energy, rail, logistics and public-service procurement provide a strong foundation.

As Standard Bank head of macroeconomic research Elna Moolman notes: “The new fiscal projections seem credible and underpinned by relatively conservative assumptions. The key fiscal metrics were broadly as we expected; Treasury is gradually restoring South Africa’s fiscal sustainability.”

In its medium-term budget policy statement (MTBPS), the Treasury also reminds us why growth matters more than ever – high dependency ratios, public-service wage demands and social spending pressures combine to squeeze fiscal space unless the working-age dividend is exploited now.

Here’s the 2025 MTBPS, by the numbers:

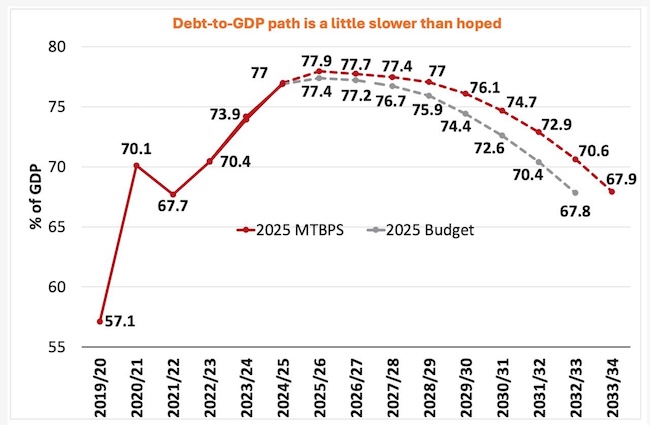

1. 77.9% – Debt stabilises

Gross debt is projected to stabilise at about 77.9% of GDP this year, the first time since 2008 that the ratio does not rise. But the glide-path downward is more gradual than earlier forecasts, largely due to revised nominal GDP and a weaker growth outlook.

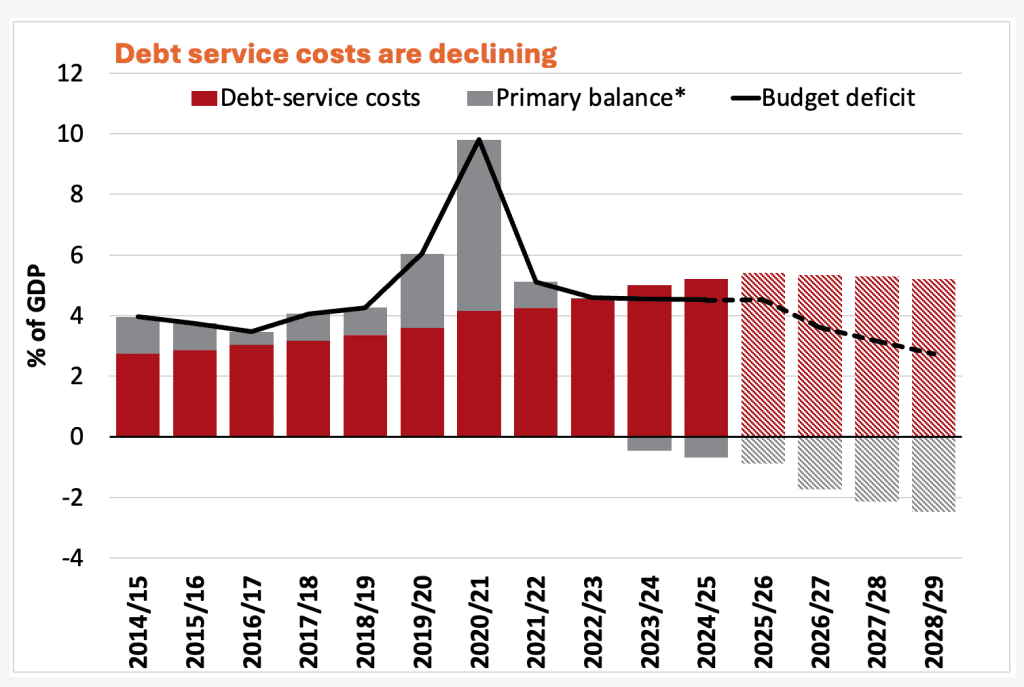

2. 21c in the rand – Debt-service still bites, but is easing

Interest costs continue to consume roughly 21c of every rand of revenue, reducing fiscal flexibility. The good news, though, is that sovereign risk premiums and bond yields have fallen, trimming this year’s cost burden and reducing future debt-service payments. Even small percentage-point improvements in funding rates translate into billions of rand saved over the medium term.

3. R924.7bn – First-half haul by Sars

In the first six months of 2025/26, tax revenue reached R924.7bn, up 9.3% year on year and about R18bn above March estimates. Roughly half of the overrun came from compliance work – revenue owed but previously unpaid – and the remainder from improving economic activity, notably in corporate earnings and household consumption. The South African Revenue Service (Sars) has boosted legal and technical capacity to pursue complex arrears. That underscores the point: better collection matters almost as much as tax-rate changes.

5. 1.8% – Growth, on average, over the next three years

Growth is modest – estimated at 1.2% in 2025, rising to an average of 1.8% annually through 2028. The upside hinges on reforms in energy, logistics and infrastructure; the downside remains a familiar list of global shocks, tariff risks and domestic execution delays.

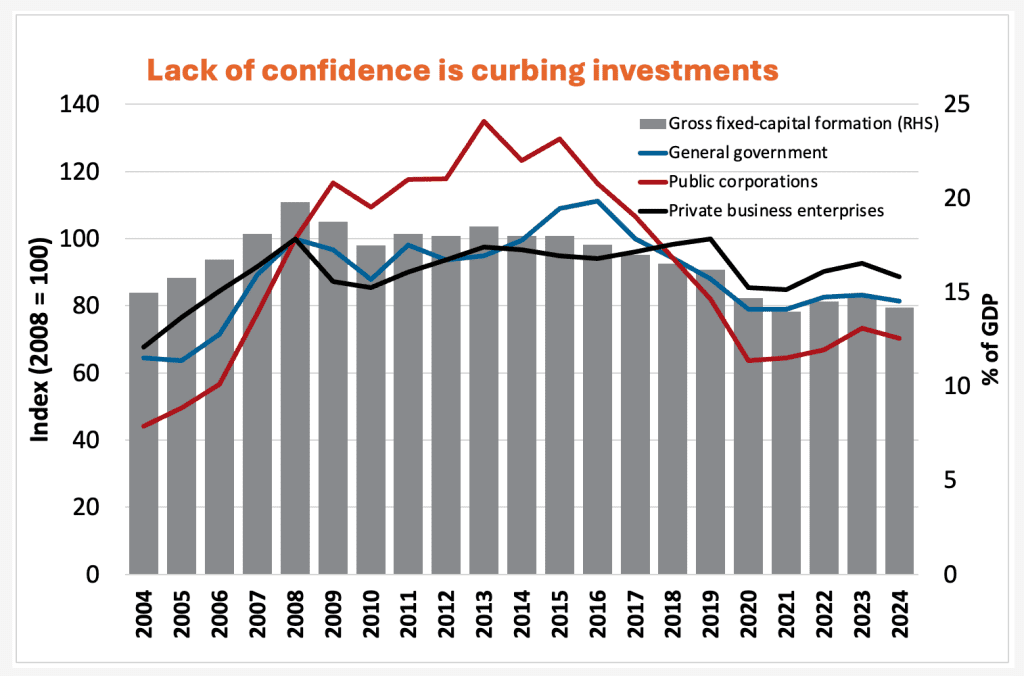

6. R1-trillion-plus – Infrastructure is being front-loaded

The budget earmarks more than R1-trillion for infrastructure investment over the next three years. Priority sectors include rail corridors, water and sanitation, ports and logistics. The model: ring-fence high-impact projects, sequence disbursements to milestone delivery and attract private-sector capital via a newly proposed credit-guarantee vehicle. It’s a crucial shift given that gross fixed-capital formation has stagnated at less than half of the 30% of GDP target.

7. R8.5bn – Two rail corridors get moving

Capital funding of R8.5bn is directed to two major corridor upgrades via Transnet, financed through the budget facility for infrastructure. These projects aim not only to revive export logistics but to reduce state-owned entity losses and generate fiscal receipts. The corridor-by-corridor approach could serve as a blueprint for private-public collaboration across infrastructure.

8. 167 – Days without load-shedding

Eskom recorded 167 consecutive days without load-shedding by the end of October. The utility also reported its first profit in a decade, yet municipal arrears and distribution issues remain a drag. The Treasury notes that distribution-agency agreements are being introduced to stabilise cash flows and reduce service interruptions.

9. 3.6% – The amount by which spending rises per year

Consolidated non-interest expenditure is projected to grow from R2.59-trillion in 2025/26 to R2.88-trillion by 2028/29, averaging roughly 3.6% a year. Importantly, the composition is shifting: the public service wage bill grows at a nominal rate of about 4.1%, while capital payments (mainly for infrastructure) grow at 7.3%, signalling a tilt towards investment rather than consumption.

10. 60% – Non-interest spending on the social wage

About 60% of non-interest spending goes to the “social wage” – health, education, social protection and community development. The Covid social relief of distress grant is extended until March 2027, with the government developing plans to link working-age recipients to skills and job programmes.

11) R6.7bn – Savings identified under Tars

The Targeted and Responsible Savings (Tars) initiative identified R6.7bn in medium-term savings by phasing out underperforming programmes and tightening social-grant verification.

12. R13.5bn – A bigger contingency to keep projects moving

The contingency reserve has been increased to R13.5bn from R5bn, covering items such as Transnet’s corridor upgrades, infrastructure co-funding, the rebuilding of parliament and preparations for the 2026 municipal elections. This buffer helps avoid stop/start expenditure and supports smoother execution.

13. Below 3% by 2028/29 – Deficit narrows

The main-budget deficit is projected to decline from about 4.5% of GDP in 2025/26 to roughly 2.7% by 2028/29. The improvement relies on the primary surplus expanding, moderate growth and discounting the impact of future tax increases.

The primary surplus – where revenue exceeds non-interest spending – is expected to improve from 0.4% of GDP in 2024/25 to about 2% by 2027/28, reinforcing fiscal discipline and helping to slow debt growth over the medium term.

14. R2.4-trillion – Revenue is on the rise

Gross tax revenue is projected to rise from about R2-trillion in 2025/26 to R2.4-trillion by 2028/29, nudging the tax-to-GDP ratio upwards. Domestic VAT collections remain resilient; import-linked taxes suffer from weaker trade, underscoring the importance of the compliance push and growth-friendly reforms.

15. 2026 – No new tax hikes (for now)

The Treasury deferred a decision on the planned R20bn tax increase for 2026, signalling confidence in current revenue momentum and compliance gains. The March-planned tax rises remain on standby, contingent on Sars performance and revenue outturns.

Asked during a media briefing whether a VAT increase might still be likely, Godongwana replied: “It’s off the table,” drawing laughter when Sars commissioner Edward Kieswetter added: “It’s under the table.”

16. New transparency – Procurement payments dashboard

The Treasury has launched a procurement payments dashboard, linking government payment data to supplier-ownership information. For the first time, the public will be able to see which departments pay which suppliers, and how much. This marks a major step towards improving accountability and reducing small-ticket procurement abuse.

17. PPP reboot – A de-risked pipeline

A new Infrastructure Finance Implementation Support Agency is set to centralise project appraisal and financing functions by March 2026 with the aim of accelerating a bankable pipeline of infrastructure deals.

Public-private-partnership (PPP) rules were updated in June 2025 to streamline processes and clarify institutional roles, while guidelines on unsolicited bids from the private sector for projects took effect in October.

18. A ticking time bomb

The MTBPS also warns of shifting demographics that could reshape South Africa’s fiscal outlook. Slowing population growth and rising life expectancy will steadily increase the number of people reliant on state support – from health and pensions to social assistance – over the coming decades.

Modelling by the Treasury based on the latest census shows the old-age dependency ratio will double by 2060, leaving fewer workers to support more retirees. It says the next two decades offer a “crucial opportunity” to harness the demographic dividend of a growing working-age population before ageing pressures tighten fiscal space and lock in higher long-term spending.

Final word

Overall, the preservation of the debt-to-GDP peak this year should be positive for South Africa’s credit ratings as it confirms the government’s commitment to fiscal consolidation, Standard Bank’s Moolman says.

However, she cautions that agencies such as S&P may hold off on an upgrade this week; it’s more likely next year. “A further increase of the forecast debt-GDP trajectory (albeit only 0.5%-0.7% of GDP), the still-weak economic growth outlook despite reform traction, and discretionary spending increases may underpin their continued caution.”

While the budget’s numbers “are encouraging”, execution risk remains high, Nedbank economists Isaac Matshego, Crystal Huntley and Nicky Weimar said in a note. “Disappointments on the growth front would hurt revenue growth and result in a weaker fiscal trajectory.”

The extension of the Covid grant, “magnifies the challenge encountered in curtailing social programmes in an economy with high unemployment”, they said. “This stresses the critical need to boost growth via investment-friendly economic policies that will not only create jobs but also boost fiscal revenue”, and strengthen the nation’s financial position.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.