Craig Mockford, the CEO of Prescient Fund Services, one of the largest firms launching new exchange traded products in the South African market, worries that exchange traded funds (ETFs) aren’t “exciting” enough.

“We’ve seen ETFs growing hugely in Europe, with a range of new funds launched in areas like biotech, defence, artificial intelligence and crypto,” Mockford tells Currency. “The challenge is: how do we make this exciting for investors?”

Well, the figures suggest investors find them pretty sexy already.

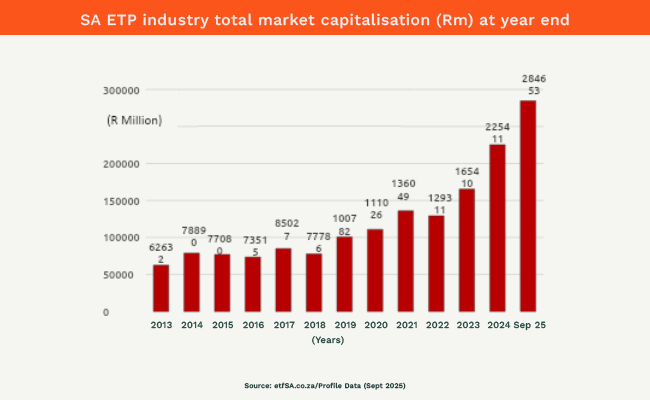

New data released this week by ETFSA shows that by October, investors had shunted R284.6bn into the asset class – effectively doubling the size of the local market in three years, from R129.3bn in 2022.

“This is an increase of 26% on the total market capitalisation of the exchange-traded products industry at the end of 2024 – nearly R60bn over nine months,” says Mike Brown, CEO of ETFSA.

This tracks global enthusiasm, too. By the end of August, Europe’s ETF industry hit a record $2.87-trillion, having grown by $240bn this year. So, not to put too fine a point on it, but a lack of sexiness doesn’t seem to be a sticking point.

Still, you can understand what Mockford means. An ETF is essentially a single stock representing a basket of assets – equities, bonds or commodities. It’s relatively safe, low cost and, well, prosaic. In many cases, ETFs track indices such as the S&P 500 or the JSE all share index. So, it’s not all lace and candles on the amour index.

Mockford’s point, however, is that ETFs don’t have to be so vanilla. And nowadays, many aren’t.

“This perception of ETFs as being largely index trackers is all wrong. Not only can you get specific exposure to exciting industries like AI, but since May 2023, we’ve had actively managed ETFs, which changed the game.”

To insiders, ETFs might still seem overlooked – the industry remains small next to South Africa’s overall assets of R4-trillion in the collective investment schemes sector, which includes products like unit trusts. But growth has been rapid, given how new these instruments are locally.

It was only in November 2000 that the first ETF was listed on the JSE – the Satrix 40 ETF, offering exposure to the largest local stocks. That was a decade after the world’s first ETF launched in Canada, tracking the Toronto 35. Today, there are 284 ETFs on the JSE, covering sectors from health care to technology, and markets from India to Japan. Issuers include Satrix, Stanlib, RMB, Investec and 10X.

“ETFs have been around for 25 years in South Africa but haven’t been nearly as successful as elsewhere,” says Ben Meyer, MD of Prescient Capital Markets. “But with the rise of trading apps and platforms like EasyEquities, there’s plenty of growth still to be had locally.”

This is a critical point. ETFs have been fundamental to the idea of financial democracy, providing retail investors with low-cost exposure to assets ranging from cryptocurrencies (though not locally) to bonds and hedge funds.

“I can say, without hesitation, that while it’s taken 25 years for the industry to hit R250bn, it won’t take another 25 to double that,” says Meyer. Awareness is growing of the role that ETFs can play – not just in providing access to foreign markets, but in managing risk.

Exchanges wilt as ETFs soar

One reason ETFs have found traction so quickly is comparatively low, transparent fees. As a Prescient Fund Services report puts it: “Unlike traditional unit trusts, ETFs listed on the JSE have a single fee class. This means every investor – whether allocating R100 via a mobile app or R10m on behalf of a pension fund – faces the same total expense ratio.”

For younger investors weaned on the Covid-era fever dream of Robin Hood or EasyEquities’ low-cost model, which now caters to 2.2-million users, that’s compelling. It makes investing easy to grasp – a key concern for 77% of investors across 13 countries in the World Economic Forum’s Global Retail Investor Outlook last year. Three in four younger investors in Europe now hold ETFs, according to EY.

Meyer says index trackers typically charge about 0.07% of fund value.

“The newer ETFs – which track the weird and wonderful – cost between 0.3% and 0.5%, and some actively managed ETFs charge up to 0.8%. It’s higher, but you’re paying for potential outperformance with lower risk.”

These actively managed ETFs, launched just two years ago, are a big attraction. But what has also helped is the JSE’s decision to halve listing fees for new ETFs – from R124,000 to R62,000.

“This is hugely beneficial,” says Mockford. “It used to make no economic sense to list an ETF under R1bn in assets, but that threshold has dropped to around R100m. It allows the market to develop faster and gives investors more choice.”

Still, while ETFs proliferate, the number of listed companies globally is shrinking. The JSE, for example, had more than 600 companies in 2000; today it has about 266. New York and London have seen similar declines as firms sell to private equity rather than list publicly.

Can ETFs survive this collapse in public markets?

“The real question is, can stock exchanges survive?” says Meyer. “ETFs can adapt – there’s no reason you can’t have an ETF wrapper on private credit assets, for example. But the jury’s out on exchanges. Of course, we want more listings, but they’ll need to adapt and become more product centric.”

Product centric, like more ETFs, perhaps. With new funds launching by the day – even as listings shrink – ETF providers will have to stay innovative, offering products that look appealing, keep costs low, and let a new generation capture the thrill of investing.

It’s a tall ask. But given the recent history of ETFs, you wouldn’t want to bet against it.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.