David Shapiro, chief global equity strategist at Sasfin Wealth, stands as one of South Africa’s most respected market commentators. With more than five decades of experience, this award-winning fund manager and art enthusiast has dedicated his career to demystifying the stock market.

In his latest reflection for Currency, Shapiro shares his essential money lessons, emphasising the discipline and focus required to build a successful portfolio. He also explores the importance of trusting your instincts, and reveals why he has no intention of ever retiring.

If money could talk, what would it say about your spending habits?

“At last, he’s spending me on memories, not canvases.” I’ve traded gallery openings for boarding passes – still an avid art enthusiast, but with walls crowded, I mostly find myself strapped into an airline seat crossing oceans to visit children and grandchildren.

What’s the most significant financial lesson you’ve learnt from your own investment experiences?

After more than 50 years in the market, I’ve learnt that discipline beats distraction. My approach is simple: if you can’t do it in 20 stocks, you’re not going to do it in 200. Portfolios, like dinner parties, work best with a handful of guests – too many seats around the table and the conversation gets diluted. I’d rather own a few high‑quality businesses and watch them carefully than scatter my attention across a crowd. Focus, not clutter, pays.

If there’s a stock you wish you would’ve invested in earlier, what would it be and why?

Capitec. One of the few South African companies that can match Big Tech in terms of returns. I admired its model from the start – simple, transparent banking for an underserved market. But while I believed in the company, I let myself be swayed by swarms of analysts and cynics warning that disaster was around the corner. They saw cracks that never materialised. Capitec kept prospering, outpacing and outsmarting the incumbents. Lesson learnt: trust your instincts – not the noise.

What’s the most extravagant purchase you’ve ever made, and do you still think it was worth it?

I’ve always collected art, with a tight budget and a fondness for etchings – especially Gerald Brockhurst (1890-1978), a British painter and etcher. Brockhurst was celebrated for his portraits of women, often featuring his muse, Kathleen Woodward. One of his greatest works, Adolescence, was on sale at a gallery in Columbus, Ohio. The price was four or five times my normal budget – madness, really – but I couldn’t stop thinking about it and eventually took the plunge. Thirty years on, in dollar terms it hasn’t skyrocketed, but with the rand’s slide it would now be far beyond my reach. I still love the work and take pride in owning it. Foolish at the time, but it’s paid in satisfaction.

What’s an unconventional asset class you’ve considered investing in?

I have two golden rules on investment. One: only buy assets you can purchase in the morning and, if pressed, sell in the afternoon. Two: avoid anything that doesn’t publish financial statements. Collectables such as art, antique furniture or rare coins are enjoyable hobbies, but leave making money to the dealers. The margin between your purchase price – or even the insured value – and the resale value on auction is as wide as the Gulf of Mexico. And if the conversation with friends ever turns to opening a coffee shop or game farm, go take a cold shower.

What advice would you give to young professionals about building wealth and managing their finances?

Your most productive years stretch from 25 to 70 – 45 years to earn, save and invest. After that, you’ll want 20 years of retirement to be comfortable, which means the savings from those working years must carry a heavy load. Twenty over 45 is a big percentage, especially when you’re housing, educating and feeding a family.

The lesson is simple: live modestly, control your costs and save as much as you can. Put your money in equities – the only asset class that will deliver adequate returns to give you peace in retirement. And stay clear of family or friends who tempt you with get‑rich schemes, tax tricks or investments built on complex equations. Lastly, remember: your home is a cost centre, not an investment. It only becomes an investment when your children send you off to a retirement home and split the proceeds of the sale.

What is your retirement plan?

Not to retire. Doing nothing is the quickest route to losing both health and sanity. Waking up, going for a run, eating breakfast, following the news, reading a book, or sitting at a drawing board takes me up to 11am. And then what? Retirement without purpose is just waiting. Stay occupied, stay constructive and keep moving forward. Watching television during the day is the fastest way to an early grave.

What financial trend do you think is overrated, and why?

Value investing. Its disciples are rigid rule‑followers who believe theirs is the only true way. They project themselves as being smarter than everyone else. They put great faith in the past – in financials that represent investments already made, not those yet to make. Markets don’t stand still – they constantly alter the price of risk, and yesterday’s valuation can be meaningless tomorrow. Cheap can stay cheap forever, sometimes for very good reasons. Or as the old joke goes: a value investor bought a painting and a violin at an auction. An appraiser told him he had good news and bad news. The good news was that he had a Rembrandt and a Stradivarius. The bad news was that Stradivari was a lousy painter, and Rembrandt couldn’t make violins to save his life.

If you were not in your current role, what company would you work for in a heartbeat?

Not in finance – I entered stockbroking by default. My aptitude was always closer to architecture or engineering. At university I caricatured classmates, and even now in meetings I draw lines on a doodle pad rather than lines on a chart. If I had my time again, I’d be studying bridges instead of balance sheets.

If you could give your younger self one piece of financial advice, what would it be – and would you actually listen?

Start saving early. Even small amounts matter, and even if you’re repaying debt, put something aside. Make savings a habit. And don’t show off – resist the temptation to buy things you can’t really afford, like an expensive motor car, no matter how cool you think it looks. Buy something affordable and put the difference into your savings account. You’ll thank yourself later for your parsimony. Would I have listened? Probably not – young people tend to worship style over reason.

How can South Africa achieve widespread financial literacy and inclusion?

Financial literacy and inclusion cannot be imposed by statute, nor can they be taught through textbooks alone. They must be lived and experienced. Businesses have a responsibility to promote them through mentorship programmes — not token gestures, but genuine inclusion. That means involving young people in every step of the business: letting them sit in on meetings, observe how boards make decisions and understand how customers are engaged. Exposure builds confidence, and confidence builds competence.

But mentorship is only one piece. We also need schools to teach the basics of saving, debt and budgeting as early as possible, so financial habits are formed before bad ones take root. Banks and corporates should simplify their language — too often financial products are wrapped in jargon that excludes rather than empowers. Ultimately, financial literacy is not about producing accountants or financial analysts; it’s about emboldening people to make informed choices.

ALSO READ:

- My worst day in the market

- How I spend my currency … with Zwelakhe Mnguni

- Put everything on black (or AI, or gold)

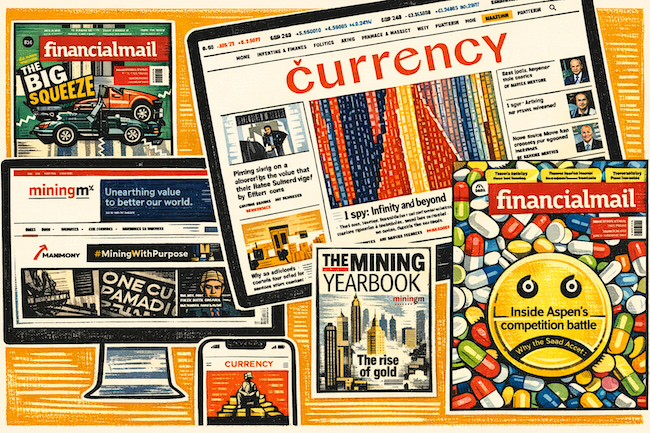

Top image: supplied.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.