In an environment where inflation data and earnings guidance can quickly swing sentiment, there’s one set of signals that often gets overlooked: soft commodity trends. Yet, for food producers and retailers, these inputs are the foundation of profitability, influencing buying strategies, pricing decisions and, ultimately, investor returns.

Over the past year, food inflation has moderated, but underneath the overall cooling is a far more complex picture. The prices of commodities like wheat, maize, soybeans, coffee and sugar – each a core input in South Africa’s food value chain – have moved in different directions, shaped by everything from climate shocks to global supply-chain shifts and local planting conditions.

This all has a bearing on the JSE’s major food-linked stocks: from Tiger Brands and RCL Foods, to AVI, Shoprite and Pick n Pay. Some are still feeling the sting of high input costs, while others are finding margin relief.

The other factor to consider is that current prices may only reflect about six months from now, assuming an average raw material procurement hedge of six months. (Generally, the minimum is three months just to cover current demand and a maximum of nine months for companies looking to capitalise on longer-term pricing expectations.)

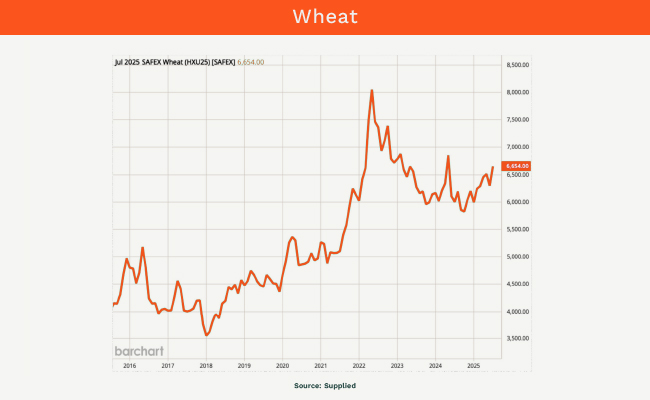

Wheat

Prices are currently trading at about R6,400 per ton, up 8% from a year ago and well above long-term averages. While global wheat prices have cooled meaningfully off their 2022 highs, where a rally was prompted by Russia’s invasion of Ukraine – one of the world’s major wheat exporters – local prices remain high due to the weaker rand and rising logistics costs.

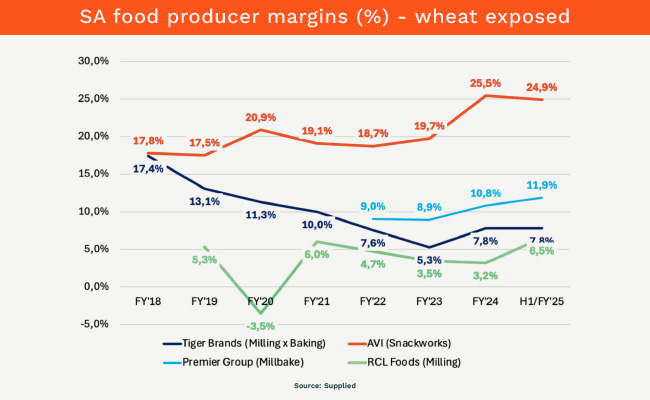

AVI (Snackworks): The blue blood of JSE-listed food groups, AVI’s margins have held up and grown since 2018, despite volatile wheat pricing cycles. AVI’s ability to shield its profitability is rooted in its premium brands and an agile pricing strategy. This makes AVI the defensive standout with consistent margins.

Tiger Brands (Milling & Baking): As a player with more commodity exposure and less premium brand equity in milling and baking, Tiger has faced significant margin squeeze thanks to the wheat price spike, especially since 2020. Its operational rigidity and commodity-linked pricing make it the most cyclical of the wheat-exposed food producers.

Premier Group (Millrace): Premier has delivered a steady increase in margins over the years thanks to successful mill upgrades, improved operational efficiencies and disciplined pricing. Its cost base is structurally leaner than Tiger’s.

RCL Foods (Baking): RCL has structurally lower margins given its less premium (and more price-sensitive) offerings, which rely on volumes. Despite a recent improvement in operating margins, RCL operates at a materially smaller scale relative to its competitors, reducing its relative ability to absorb costs.

In the highly competitive grain segment, the margin winners are those with brand strength, disciplined pricing and operational finesse.

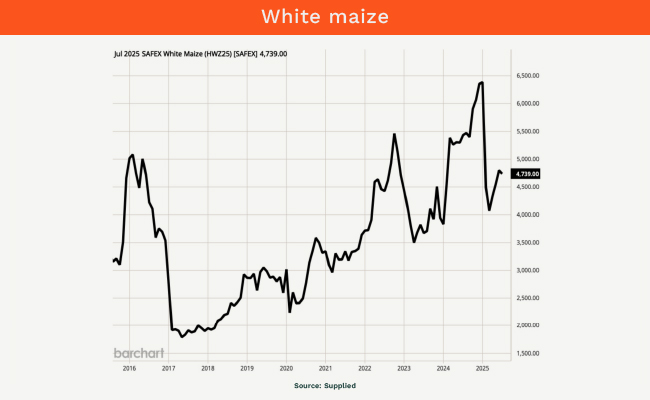

Maize and poultry

Poultry producers on the JSE are especially exposed to three key soft commodities: white maize, yellow maize and soybeans.

White maize prices are currently trading at between R4,300 and R4,800 per ton, down 18% from a year ago, but still high against long-term averages. Similar to wheat, local prices are higher than global prices, given the combination of a weaker rand, local weather-related disruptions and higher operational input costs.

Yellow maize, meanwhile, is the major feed input for poultry producers, and prices spiked to more than R5,500 per ton during late 2024 amid El Niño-induced dryness locally and strong global demand for corn from China and the US. Despite benefits from this year’s summer rains, prices remain 20%-30% above pre-2022 levels and 40%-50% above pre-pandemic levels. It means margins for poultry groups have come under prolonged (and potentially structural) downward pressure.

As for soybeans, prices have pulled back sharply from 2022 due to a surge in South American output and falling global energy prices, given that soy oil prices correlate to biofuel prices. Still, soybean prices remain well above the roughly R4,800 per ton levels that characterised the pre-pandemic era.

These two cost inputs are key for local chicken firms, where feed makes up as much as 70% of a producer’s cost base.

Unless Astral and RCL – the two major listed poultry groups on the JSE – find more efficiencies or raise prices (a tough call in this consumer climate), their profits will likely stay subdued well into 2026.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.