National Wills Week, which ends on Friday, is a reminder of one of the simplest yet most neglected acts of financial planning: drafting a will. Despite widespread awareness, the majority of South Africans still don’t have one – leaving families exposed to unnecessary legal and financial turmoil when loved ones pass away.

The latest Sanlam Legacy Wills Survey underscores the urgency. Approximately 66% of South Africans still do not have a will, a five percentage point increase from last year.

Seven in 10 believe a will is worthwhile even with assets under R50,000, yet only about a third have drafted one – evidence of a stubborn “intention-action” gap. Misconceptions about “not having enough” assets, cultural taboos and plain inertia serve as the main barriers.

“A will isn’t just about money; it’s your final act of care and last wishes for your family,” says Walter Combrink, life risk and fiduciary manager at Momentum Financial Planning. “Without it, the state decides how your estate is divided, which can spark disputes, delays and immense stress at a time when your loved ones are most vulnerable.”

Dying intestate hands control to the Intestate Succession Act, not to your preferences. That can delay the appointment of an executor, freeze assets and push families into conflict. Family tension ranks as the most feared consequence in the Sanlam Legacy Will Survey, followed by long delays in winding up estates.

For business owners, the stakes are higher. Without a will that embeds a succession plan, operations can stall, value can erode and jobs can be at risk. Combrink is blunt: a valid will is often the single-most important document for business continuity.

What moves people to act

Hard facts don’t always move people – lived experience does. Sanlam’s survey shows 41% were prompted to draft a will after seeing the chaos of an intestate death; 38% after having a child; 31% after a family death. Legally, you can make a will from age 16, yet many delay, citing “too few assets” (43%), unemployment (30%) or inertia (27%).

PSG Wealth legal specialist Mariska Redelinghuys stresses that a will executes your estate plan – no matter the size of your assets. Even a modest bank balance forms part of an estate and must be administered.

In 2025, estates aren’t just bricks and mortar. Sunette Ansara, head of group legal and legal insurance at JustMoney, warns that digital assets – from crypto and online shops to loyalty points, social media and cloud subscriptions – are often overlooked.

She recommends noting them in your will, appointing a “digital heir” to manage accounts, and ensuring your executor can identify and value crypto or other digital property.

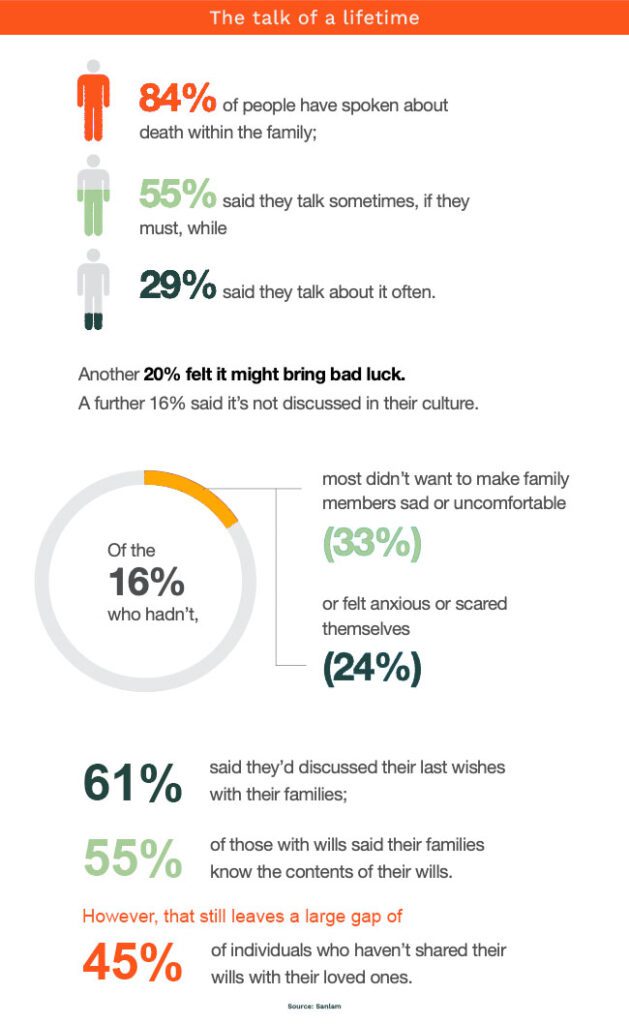

Estate habits are learnt: those whose parents or grandparents had wills are more likely to have one. Yet only about a third of parents currently have wills, risking gaps in guardianship or ring-fencing for minors. Families talk about death – 84% say they do – but nearly 45% of those with wills haven’t shared the contents, leaving loved ones in the dark.

Sanlam’s research shows the biggest enablers are simple: free or low-cost drafting, step-by-step guides and trusted advice. Wills Week delivers precisely that.

Choose the right executor

A will is only as effective as the person who executes it. In South Africa, the executor reports the estate to the Master of the High Court, identifies, secures and values assets, settles debts and taxes, and distributes what remains to beneficiaries. It’s a technical, time-consuming job – months, sometimes years – so competence and neutrality matter.

Consider co-executors (a trusted relative plus a professional) for balance. Know the costs: the prescribed executor tariff is up to 3.5% of the gross value of estate assets (plus VAT) and 6% of income collected after death – another reason to appoint someone who will add real value and progress matters efficiently.

How to move from intention to action

- Be specific: record guardianship wishes for minors, bequests and any charitable legacies.

- Include digital assets: list key accounts, crypto holdings and instructions, and name a digital heir (in line with platform rules).

- Tell someone: share the will’s location with your executor and a family member; keep certified copies safe.

- Review it after life events: marriage, divorce, birth, property purchases or regulatory/tax changes.

- Entrepreneurs: write down a business succession plan (who runs it, whether it’s sold, and how proceeds are distributed).

- Act now: if you act by Friday, participating attorneys will draft a basic will for free during a campaign run under the auspices of the Law Society of South Africa, which lists participating firms on its website.

Ultimately, a will is less about what you own than who you love. In National Wills Week, take an hour to turn intention into action and leave the people you care about with clarity – not conflict.

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.