A tax-free savings account (TFSA) is one of the most powerful investment tools available to South African investors. When used properly, it can deliver completely tax-free returns, not just today but for life. While TFSAs are flexible, their true potential lies in long-term investing, allowing your capital to compound over decades.

A TFSA can outperform other investment options when you know how to make the most of your contributions and what strategies help you maximise your long-term growth.

Before we get into strategy, here’s what you need to know:

- You can contribute up to R36,000 per tax year (between March 1 and the end of February).

- You can contribute a maximum of R500,000 over your lifetime.

- If you withdraw money, you cannot contribute it again.

- Overcontributions are penalised at 40% of the excess amount.

- All interest, dividends and capital gains are tax-free forever.

Though a TFSA allows withdrawals at any time, it is not intended as an emergency fund. The real value comes from leaving it invested for as long as possible and letting compounding do the heavy lifting. Once money is withdrawn, that portion of your lifetime limit is gone for good.

Should I contribute to a TFSA or a retirement annuity?

Here’s the key difference:

- TFSA contributions are made with after-tax money, but all growth and withdrawals are tax-free.

- Retirement annuity (RA) contributions are tax-deductible, but withdrawals in retirement are taxed.

In practice, this means an RA contribution only adds real value if the tax you save today is greater than the tax you’ll pay later.

As a general guideline, if you’re in a lower to moderate tax bracket – often about 31% or below – you may benefit from prioritising your TFSA contributions first. At these levels, the immediate tax deduction available through an RA is less significant, while a TFSA allows capital to grow tax free over the long term.

There’s also flexibility to consider:

- RAs have strict access rules. Before age 55, access to the investment is very limited. At retirement, up to one-third may be taken as a lump sum, subject to the retirement lump sum tax tables. The balance must be used to purchase an annuity that pays a monthly income, which is subject to income tax.

- RAs are constrained by regulation 28, which limits offshore exposure to 45%. In contrast, TFSAs allow full offshore equity exposure, which has historically delivered higher long-term growth (some providers may have platform limitations on offshore exposure).

There’s no one-size-fits-all answer. The right balance depends on your income, tax rate and long-term goals – and this is where proper financial planning makes all the difference.

Why invest in a TFSA rather than a flexible investment?

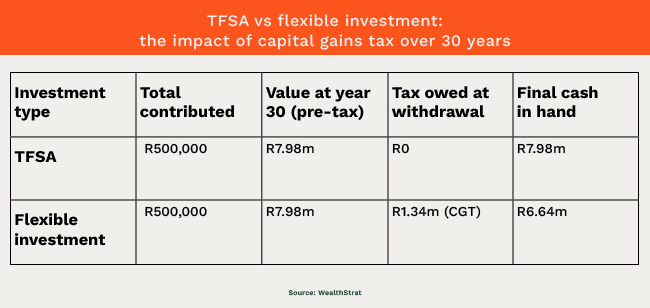

To understand the real power of a TFSA, let’s compare it to a flexible investment. This removes the access constraints of an RA from the equation.

We’ll need to make some assumptions:

- Contributing R36,000 per year, at the start of the tax year, until the R500,000 threshold has been met.

- A return of 12% a year on both the TFSA and the flexible investment.

- No withdrawals until year 30.

- Effective capital gains tax at 18% at the end of 30 years.

Same contribution. Same return. A R1.34m difference, purely due to tax.

How should you invest in your TFSA?

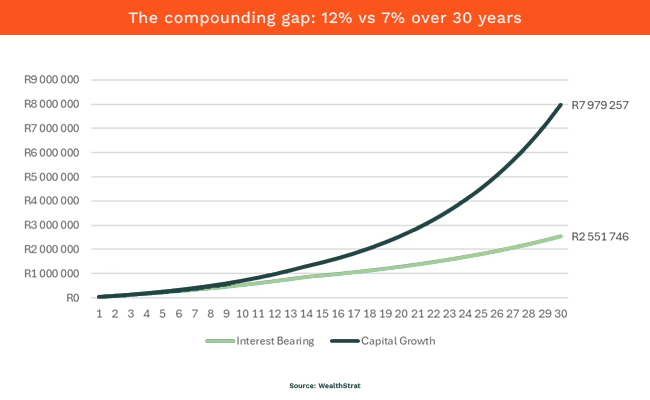

Since the biggest benefit of a TFSA is the savings on capital gains tax, the best way to maximise your growth is to invest in high-growth assets. This typically means a portfolio with high exposure to equities, especially offshore equities, which have historically returned at least 12% a year.

You may wonder why your bank is offering you a TFSA, since the tax benefit of not paying tax on interest is substantial. But a tax-free return of 7% is still less than one of 12%. It can mean a difference of R5.4m after 30 years. Therefore, maximising the return you can get is essential to long-term performance.

R3,000 a month at the start of each month vs R36,000 in March?

Yes, there is a marginal mathematical advantage to contributing R36,000 at the start of the tax year rather than R3,000 per month. The money is invested earlier, which means more time to compound.

Over 30 years, the investor who contributes annually upfront ends up with roughly R400,000 more.

However, here’s the part that matters more than the spreadsheet. If contributing annually means the money sits in your bank account and somehow “disappears”, then the strategy has already failed. For many investors, a monthly debit order is far more effective than relying on discipline and timing a large lump sum once a year.

Consistency beats optimisation.

A TFSA funded monthly, year after year, will always outperform one that was supposed to be funded annually but you never quite get around to it.

If a monthly debit order is what ensures the contribution actually happens, then that is the better strategy. Always.

Investing in a TFSA isn’t just about saving – it’s about supercharging your wealth over time. By staying invested, prioritising high-growth assets like equities, and contributing consistently, you can take full advantage of the tax-free benefits.

If you’re not sure whether your TFSA is working as hard as it could be, speak to your financial planner. When it comes to compounding, every year counts.

In conclusion

- A TFSA allows all growth and withdrawals to be completely tax free for life, making it one of the most powerful long-term investment tools available.

- Contributions are limited (R36,000 per year, R500,000 over a lifetime), so starting early and staying invested is critical.

- Once money is withdrawn, that portion of your lifetime limit is lost forever. TFSAs reward patience, not flexibility.

- When invested in high-growth assets like equities, a TFSA can materially outperform an interest-bearing TFSA portfolio and a taxable investment over time.

- Consistency beats perfection. The best TFSA strategy is the one you actually stick to. A monthly debit order beats the intention of making an annual lump sum.

Liza Brink is an associate investment analyst at WealthStrat, a division within Chartered Wealth Solutions. A certified financial planner professional and a CFA charterholder, Brink supports the investment team through manager research, fund analysis and performance attribution with a strong interest in practical investment implementation.

ALSO READ:

- Want tax-free savings for your kid? Here’s what to do – and not

- As the tax deadline looms, here’s how to pay less (legally)

- A pleb’s guide to spending your year-end bonus

Top image: Rawpixel/Currency collage.

Sign up to Currency’s weekly newsletters to receive your own bulletin of weekday news and weekend treats. Register here.